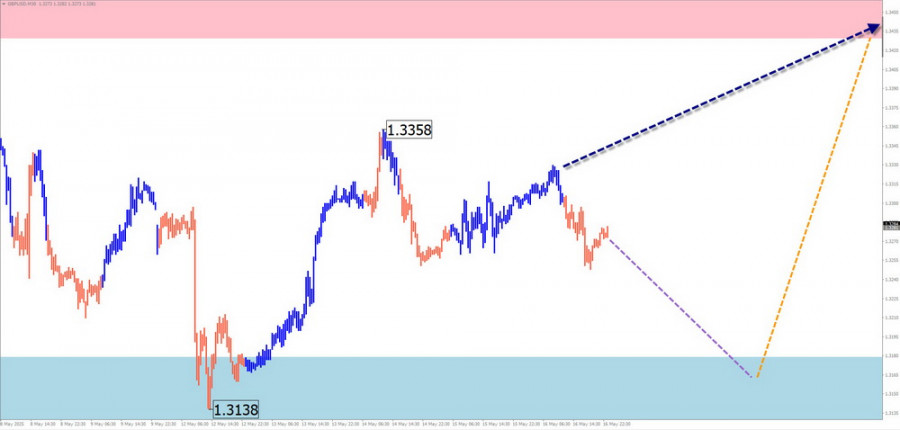

GBP/USD

Analysis: Since April 8, GBP/USD has been moving upward on the price chart. From the lower boundary of the potential reversal zone, a counter-correction has been forming for the past two months. The upward leg from May 21 holds reversal potential. If confirmed, the short-term trend will likely resume its main upward trajectory.

Forecast: Over the next couple of days, the current decline is expected to conclude. There may be downward pressure on the support zone, including a brief dip below its lower boundary. A chance for a reversal and resumption of price growth may emerge by the end of the week.

Reversal Zones:

- Resistance: 1.3430 / 1.3480

- Support: 1.3180 / 1.3130

Recommendations:

- Selling: High risk and limited potential.

- Buying: Viable after confirmed reversal signals appear near the support zone.

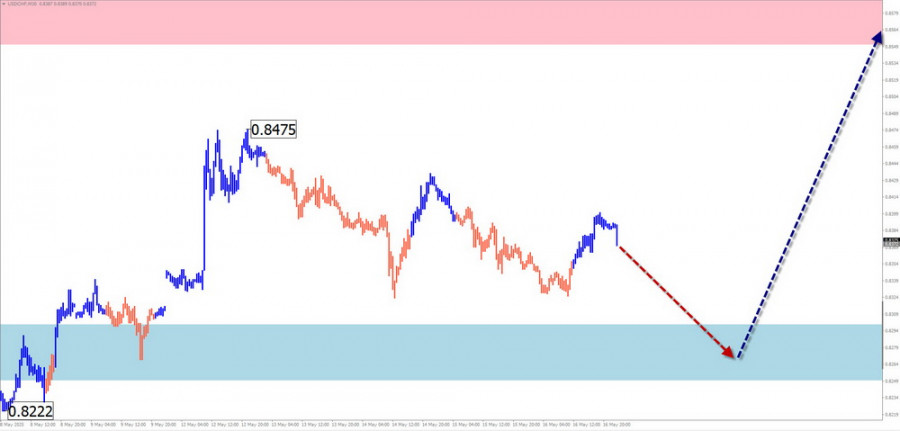

AUD/USD

Analysis: The short-term wave structure from April 4 is upward, but for the past three weeks a corrective downward wave has been forming. There are no clear signals of its imminent completion. The price is trapped in a narrow range between strong opposing zones.

Forecast: The downward movement may continue in the first half of the week, with potential pressure on the lower boundary of support. A reversal is more likely in the second half of the week, with a price rise expected closer to the weekend.

Reversal Zones:

- Resistance: 0.6460 / 0.6510

- Support: 0.6350 / 0.6300

Recommendations:

- Selling: Low potential; reduce trade size.

- Buying: Can be considered after reversal signals near support.

USD/CHF

Analysis: Since the beginning of the year, USD/CHF has been on a downward trajectory. From the upper boundary of a strong potential reversal zone on the higher timeframe, a stretched corrective flat has been forming since mid-April. The correction is still incomplete.

Forecast: A continuation of the downward trend is likely in the first half of the week. A reversal may follow later, likely within a sideways movement. A renewed price increase could begin closer to the weekend.

Reversal Zones:

- Resistance: 0.8550 / 0.8600

- Support: 0.8300 / 0.8250

Recommendations:

- Selling: High risk, low potential.

- Buying: Premature without confirmed reversal signals near support.

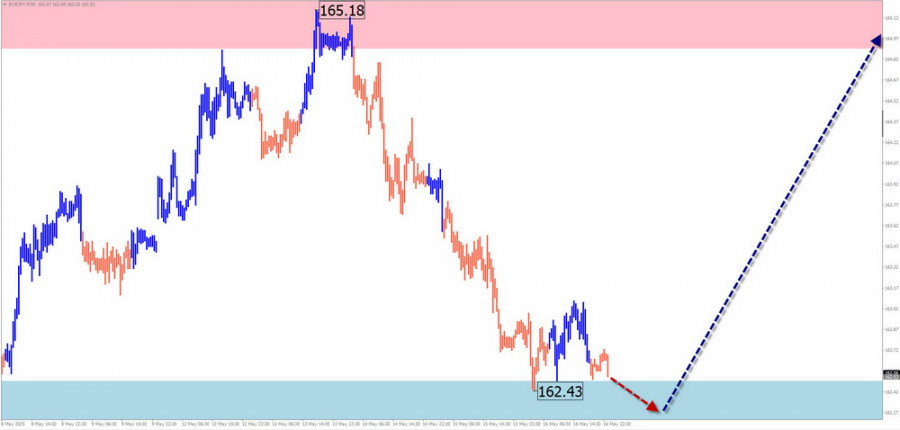

EUR/JPY

Analysis: Since late February, EUR/JPY has been forming an upward wave. A counter-correction has been developing since early May, currently forming a contracting flat and approaching completion.

Forecast: Further downward movement is likely in the coming days. In the support zone area, expect a shift into a sideways pattern and reversal conditions. A brief dip below support is possible. Renewed upward movement may begin by the end of the week.

Reversal Zones:

- Resistance: 164.00 / 164.50

- Support: 162.10 / 161.60

Recommendations:

- Selling: Possible in fractional volumes within individual sessions; limited potential.

- Buying: Premature without confirmed reversal signals near support.

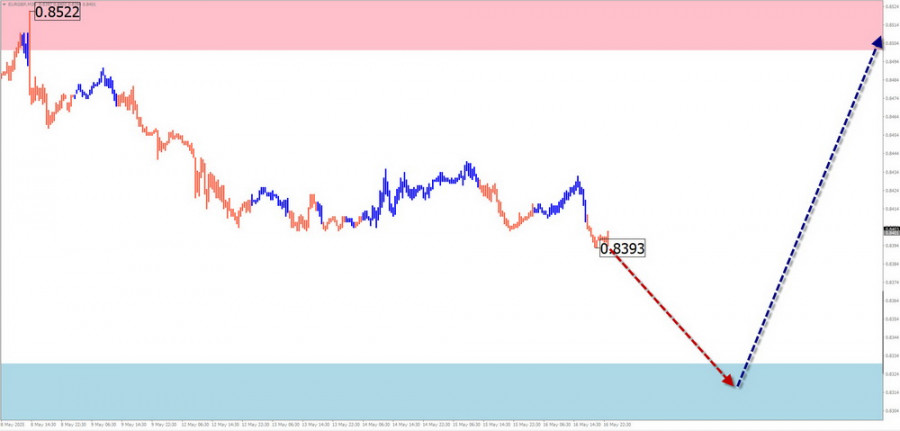

EUR/GBP

Analysis: EUR/GBP has been trending downward since early April. Last week, a sideways correction developed within a narrow range between opposing zones.

Forecast: A flat trend is expected to continue at the start of the week, with a potential decline toward the support zone. A breakout below its lower boundary is unlikely. A reversal and upward movement may begin in the second half of the week.

Reversal Zones:

- Resistance: 0.8500 / 0.8550

- Support: 0.8330 / 0.8280

Recommendations:

- Selling: Possible in fractional volumes during individual sessions.

- Buying: Only after confirmed reversal signals appear near support.

US Dollar Index (DXY)

Analysis: Since February 3, DXY has been forming an unfinished downward wave. After reaching the upper boundary of a major reversal zone, a stretched correction began on April 11. A downward leg started last week with reversal potential.

Forecast: A flat trend is expected throughout the week. After a potential retracement to the resistance zone, expect the formation of a sideways pattern and a new downward move toward the support zone.

Reversal Zones:

- Resistance: 101.50 / 101.70

- Support: 100.00 / 99.80

Recommendations: The recent upward phase for the dollar is in its final stage. After another possible short-term rise, a trend reversal and renewed weakening of the USD are likely.

Notes: In Simplified Wave Analysis (SWA), all waves consist of three segments (A-B-C). The analysis focuses on the last unfinished wave on each timeframe. Dashed lines indicate expected movements.

Warning: The wave algorithm does not account for the duration of price movements over time.