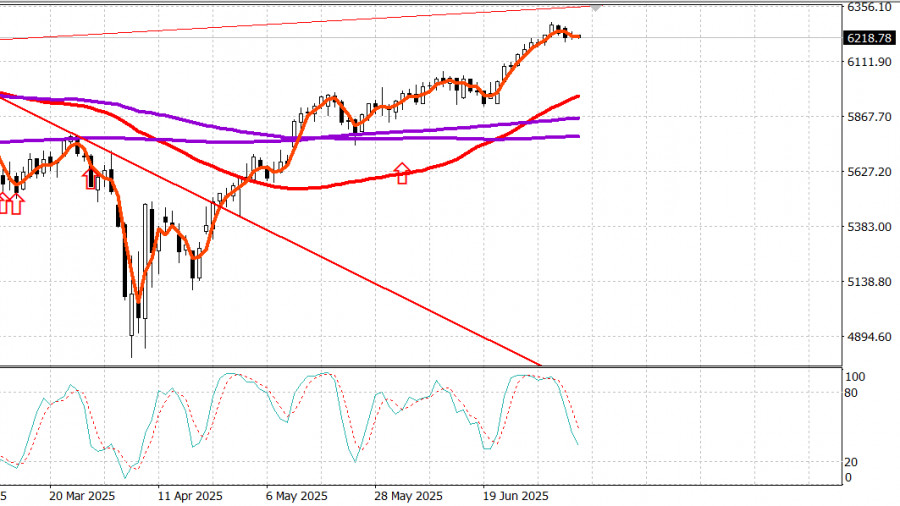

S&P500

Snapshot of major US stock indices on Tuesday:

- Dow -0.4%,

- NASDAQ -0.1%,

- S&P 500 -0.1%, S&P 500 at 6,225, within the range of 5,900 to 6,400

A lack of significant developments on the tariff front, combined with a balance between outperformance of small- and mid-cap stocks and underperformance of large-cap companies, kept the major indices trading in a narrow range near opening levels following yesterday's consolidation.

After signing an executive order officially extending the tariff deadline from July 9, President Trump stated that there would be no further extensions past August 1 for countries that received tariff letters yesterday, as well as those expected to receive them today, tomorrow, or in the near future.

US Commerce Secretary Howard Lutnick told CNBC that the EU had made "significant real offers" to open its markets to the US, although preliminary reports now suggest the EU will receive a letter from the Trump administration in the coming days.

Overall, the developments on the tariff front were in line with expectations and had little overall impact on the markets, although some of President Trump's new actions did influence individual sectors.

Copper prices surged, with copper futures closing up $0.56, or 11.2%, at $5.58 per pound after President Trump announced a 50% tariff on copper, likely to take effect on August 1.

Shares of Freeport-McMoRan (FCX 46.29, +1.16, +2.57%) jumped following the announcement, helping the materials sector (+0.8%) become one of the day's leaders.

Oil companies, part of the strong-performing energy sector (+2.7%), benefited from President Trump's executive order eliminating subsidies for "green" energy sources such as wind and solar, in support of the "Big Beautiful Bill."

Shares of ConocoPhillips (COP 95.65, +3.10, +3.35%), Chevron (CVX 152.93, +5.53, +3.75%), and Exxon Mobil (XOM 114.14, +3.03, +2.73%) rose after the order, also supported by higher oil prices, with crude oil futures climbing 0.5% to $68.30 per barrel.

While the overall market remained relatively steady throughout the session, some noticeable trends helped maintain index stability.

Notably, small- and mid-cap stocks outperformed mega-caps, with the Russell 2000 (+0.7%) and S&P Midcap 400 (+0.5%) outpacing the S&P 500 (-0.1%), while the Vanguard Mega Cap ETF (-0.15%) lagged.

Positive breadth readings—where advancing stocks outnumbered decliners by nearly 2:1 on the NYSE and Nasdaq—further confirmed this trend.

The financial sector (-0.9%) was among the weakest, in part due to large-cap components. HSBC downgraded JPMorgan Chase (JPM 282.66, -9.31, -3.2%), Bank of America (BAC 47.14, -1.52, -3.1%), and Goldman Sachs (GS 697.04, -13.88, -2.0%).

Tesla (TSLA 297.81, +3.87, +1.32%) recovered from negative press the previous day, but weak performance from top component Amazon (AMZN 219.33, -4.14, -1.9%) weighed on the consumer discretionary sector (-0.6%), following reports that Prime Day sales were down 14% year-over-year.

Additionally, lackluster performance from Apple (AAPL 210.01, +0.06, +0.0%) and Microsoft (MSFT 496.62, -1.10, -0.2%) capped further gains in the tech sector (+0.4%), despite impressive results from semiconductor stocks, which pushed the PHLX Semiconductor Index up 1.8%, nearly offsetting the previous day's 1.9% loss.

US Treasury bonds came under modest selling pressure today, mostly ahead of the cash session. The cash session saw little change across the curve, despite a relatively weak 3-year bond auction and chatter about upcoming additional tariffs (and tariff letters).

However, a New York Fed survey showing a decline in short-term inflation expectations provided some support, along with prevailing sentiment that more favorable trade agreements will ultimately be reached and that tariffs on key partners will be less burdensome than feared.

Market participants will continue monitoring developments on the tariff front and Wednesday's release of the FOMC minutes, hoping for some shift in the week's otherwise sluggish start.

Year-to-date performance:

- S&P 500: +5.9

- Nasdaq: +5.7%

- DJIA: +4.0%

- S&P 400: +1.6%

- Russell 2000: -0.1%

Economic calendar on Tuesday The NFIB Small Business Optimism Index for June was virtually unchanged at 98.6 (previous: 98.8).

The high yield of 3.891% in the $58 billion three-year Treasury auction declined to 3.887% at the time of market placement, amid weak demand from indirect bidders.

Consumer credit in May rose by $5.1 billion, following a downwardly revised $16.9 billion gain in April (originally reported as $17.9 billion). The growth was entirely due to a rise in non-revolving credit, which increased by $8.6 billion.

Energy market

Brent oil is now trading at $70.10. Oil is attempting to hold above the $70 level, but this is challenging amid increased output from OPEC countries.

Conclusion

The US stock market is consolidating. This increases the odds of a new bullish move.