Analysis of Trades and Trading Tips for the British Pound

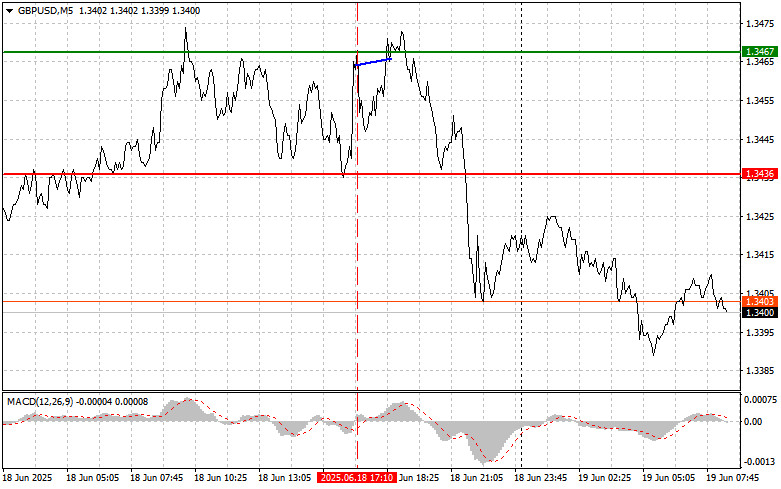

The test of the 1.3467 level occurred when the MACD indicator was beginning to rise from the zero mark, confirming a valid entry point for buying the pound. However, the pair failed to deliver a significant upward move.

Yesterday's decline in the British pound continued the trend that began after the U.S. Federal Reserve's decision. On Wednesday, the Fed unanimously decided to keep its benchmark interest rate unchanged in the 4.25%–4.5% range. In addition, the Fed released updated economic forecasts indicating slower economic growth, rising inflation, and higher unemployment for the current year. These projections put extra pressure on the pound, intensifying fears of a global recession and its potential impact on the UK economy. Investors are concerned that a slowdown in global growth could reduce demand for British goods and services, which would likely hurt corporate profits and weaken the pound.

Today, the Bank of England is set to announce its decision on the main interest rate, along with the release of the monetary policy summary. It is expected that policymakers will leave rates unchanged. The market is holding its breath in anticipation of the Bank's decision. If the rate is kept unchanged, this could act as a temporary relief for the pound, which has recently come under pressure from a strong U.S. dollar. However, attention will soon shift to the policy summary, offering deeper insight into the BoE's economic assessments and future plans. It will be especially important to watch the statement's tone, particularly about inflation, growth prospects, and labor market conditions.

If the summary turns out to be more hawkish than expected, it could lead to a stronger rally in the pound. Conversely, the pound may quickly lose ground if the Bank expresses concern over economic slowdown or signals readiness to ease monetary policy.

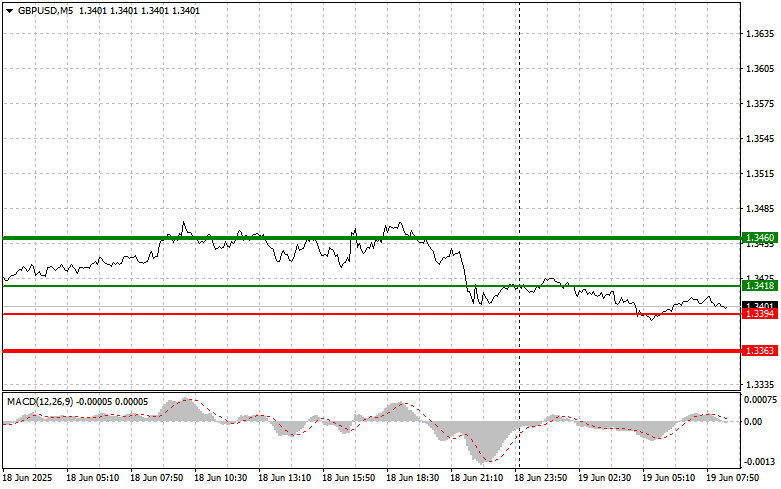

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

Scenario #1: I plan to buy the pound when the entry point around 1.3418 is reached (green line on the chart), targeting an upward move to 1.3460 (thicker green line). Near 1.3460, I intend to exit long positions and enter short positions, expecting a 30–35 pip pullback. A bullish outlook for the pound today can only be justified if the BoE adopts a firm stance.

Important: Before buying, ensure the MACD is above the zero mark and starting to rise from it.

Scenario #2: I also plan to buy the pound if the price tests 1.3394 twice a row while the MACD is in the oversold area. This will limit the downside potential and lead to a bullish reversal—expected targets: 1.3418 and 1.3460.

Sell Scenario

Scenario #1: I plan to sell the pound after a breakout below 1.3394 (red line on the chart), expecting a swift decline. The main target will be 1.3363, where I plan to exit the short trade and open a long position, anticipating a 20–25 pip reversal. Selling the pound is appropriate if the BoE's tone is dovish.

Important: Before selling, ensure the MACD is below the zero mark and starting to decline.

Scenario #2: I also plan to sell the pound if the price tests 1.3418 twice in a row while the MACD is in the overbought area. This will limit the upward potential and may trigger a bearish reversal—expected downside targets: 1.3394 and 1.3363.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.