GBP/USD 5-Minute Analysis

On Wednesday, the GBP/USD currency pair recovered throughout the day following Tuesday's sharp decline. The drop in the British pound was likely linked to the possible involvement of the U.S. in the war against Iran. Donald Trump is now trying to establish peace in the Middle East—though peace, of course, on his own terms. For the second time, the market reacted by buying dollars on news of escalation in the Middle East, but just like the first time, the chances of continued dollar strengthening are slim.

Yesterday, the UK published its inflation report for May. Consumer prices slowed to 3.4% year-on-year, which doesn't change much. Inflation in the UK remains too high, and the Bank of England likely already regrets its most recent monetary policy easing. Today, the British central bank will hold its next meeting, and there is little doubt that interest rates will remain unchanged—especially since the UK economy has recently grown faster.

Technically, the broader picture is best seen in the 4-hour timeframe, where the market remains in a sideways range even after yesterday's decline. Therefore, we believe the probability of a renewed rally in the British currency remains high, as the fundamental backdrop has not shifted in the dollar's favor.

During the third trading day of the week, the price bounced off the 1.3439 level three times on the 5-minute chart. Each bounce was limited to 25 pips. As such, none of the buy trades could result in a loss (there were no sell signals), but the profit potential was also limited.

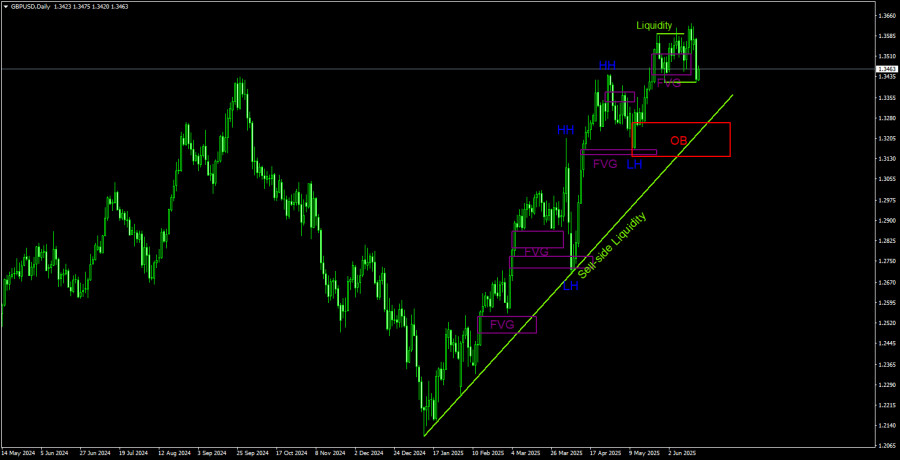

GBP/USD 1D Chart Analysis – ICT

On the daily chart using the ICT methodology, a strong uptrend remains. Tuesday's decline should not concern traders—it may simply have been a liquidity grab for further buying. The pair has two local lows from which liquidity could be taken before a continued rise. Liquidity has already been swept from the first low. The most recent bullish Fair Value Gap (FVG) was tested twice and responded both times, making it less relevant now. A bullish Order Block remains below, and a drop to that level could precede a trend continuation. However, at this stage, any dollar strength is viewed with skepticism.

COT Report

COT (Commitment of Traders) reports on the British pound show that commercial trader sentiment has fluctuated continuously in recent years. The red and blue lines representing net positions of commercial and non-commercial traders frequently cross and mostly hover near the zero mark. They are still close to each other, indicating an approximate balance of buy and sell positions. However, the net position has grown over the past year and a half.

The dollar continues to decline due to Trump's policies, so market makers' demand for the pound isn't particularly crucial at the moment. If the de-escalation of the global trade war resumes, the U.S. dollar could have a chance to rebound. According to the latest report on the British pound, the "Non-commercial" group opened 7,400 BUY contracts and closed 9,000 SELL contracts. As a result, the net position of non-commercial traders increased by 16,400 thousand contracts over the reporting week—a significant gain.

Recently, the pound has strengthened sharply, but the reason is singular—Trump's policies. Once this factor is neutralized, the dollar may start to recover. But when will that happen? No one knows. Trump is still in the early phase of his presidency. What other shocks await in the next four years?

GBP/USD 1-Hour Analysis

In the hourly chart, GBP/USD is no longer trending upward—it's moving sideways. The U.S. dollar occasionally corrects, but the market remains tilted toward buying in the medium term. The dollar improved slightly ahead of the Fed meeting, but markets won't endlessly respond to every new headline from the Middle East. The clearest technical picture is on the 4-hour chart, which shows a flat trend. The market's reaction to the Fed meeting might be emotional and unlikely to alter the technical setup.

For June 19, the following important levels are highlighted: 1.3050, 1.3125, 1.3212, 1.3288, 1.3358, 1.3439, 1.3489, 1.3537, 1.3637–1.3667, and 1.3741. The Senkou Span B line (1.3514) and the Kijun-sen line (1.3521) may also serve as signal sources. It is recommended to place a Stop Loss at breakeven if the price moves 20 pips in the desired direction. The Ichimoku indicator lines may shift throughout the day, which should be considered when determining trading signals.

On Thursday, the Bank of England will announce the results of its monetary policy meeting, but the decision on interest rates is already widely anticipated. What matters most are the vote results of the Monetary Policy Committee. Only two members are expected to vote in favor of a rate cut. If there are more, the pound may come under some pressure. However, the uptrend remains intact, and the outlook for further growth in the pound remains strong.

Illustration Explanations:

- Support and resistance price levels – thick red lines where movement may end. They are not trading signal sources.

- Kijun-sen and Senkou Span B lines—These are strong Ichimoku indicator lines transferred to the hourly timeframe from the 4-hour one.

- Extremum levels – thin red lines where the price has previously rebounded. These act as trading signal sources.

- Yellow lines – trend lines, trend channels, and other technical patterns.

- COT Indicator 1 on the charts – the size of the net position for each category of traders.