Geopolitics Rattle Global Markets Again

Wall Street futures and European shares dipped during Monday's Asian session as investors responded to renewed tariff threats from the United States. Despite the aggressive tone, many still believe President Trump's remarks might be more bark than bite.

Trump Revives Trade Tensions

On Saturday, U.S. President Donald Trump declared he would impose a 30 percent tariff on most imports from the European Union and Mexico starting August 1. The statement came despite ongoing trade talks with both regions and quickly triggered anxiety among market participants.

Europe Holds Off, But Warns of Retaliation

The European Union announced it would extend its suspension of countermeasures against U.S. tariffs until early August, reaffirming its commitment to dialogue. However, Germany's finance minister warned that the bloc should be prepared to act decisively if Washington follows through.

Markets Stay Cautious, Not Panicked

Having grown accustomed to the unpredictability of Trump's trade tactics, investors reacted with restraint. Stock indices saw only modest declines, and the U.S. dollar remained stable against the euro.

Asia Sees Mixed Reactions

The MSCI index tracking Asia-Pacific stocks excluding Japan slipped by 0.1 percent, while Japan's Nikkei stayed flat. Chinese blue-chip stocks posted a modest 0.2 percent gain following stronger-than-expected export data.

Chinese Export Growth Surprises

June trade figures showed China's exports rose 5.8 percent year-over-year, defying analyst forecasts, even as shipments to the U.S. dropped by nearly 10 percent. Markets are now focused on Tuesday's upcoming economic releases, including retail sales, industrial output, and GDP data.

European Markets Waver on Tariff Threats

European stocks reacted more sharply to renewed U.S. tariff threats, with EUROSTOXX 50 futures falling by 0.6 percent and DAX futures slipping by 0.7 percent. Meanwhile, FTSE futures held steady, showing no significant movement.

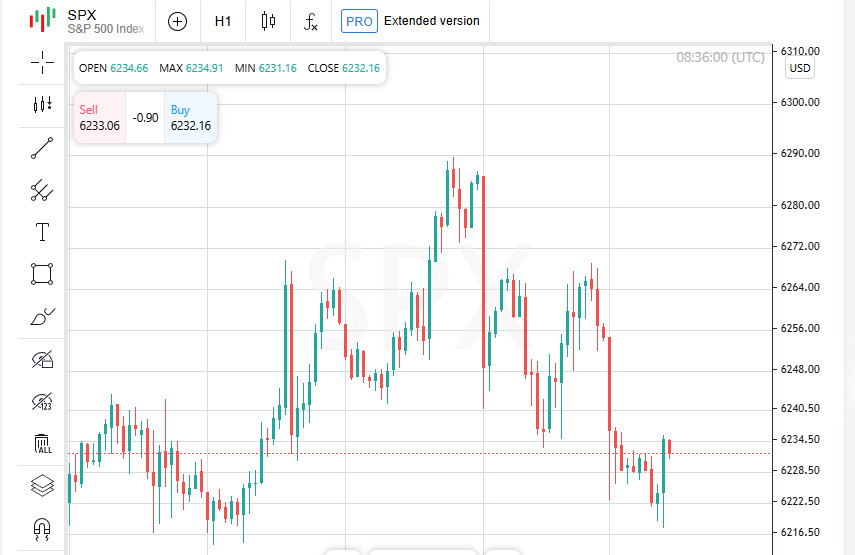

Wall Street Awaits Earnings Season Kickoff

S and P 500 and Nasdaq futures edged down by 0.4 percent as investors braced for the beginning of the corporate earnings season. Major U.S. banks are expected to report first, with results due as early as Tuesday.

Profit Growth Outlook Cools

According to LSEG IBES, S and P 500 companies are projected to post earnings growth of 5.8 percent year over year for the second quarter — a notable downgrade from the 10.2 percent forecast issued in early April. Analysts at BofA see signs of further slowdown, with consensus pointing to just 4 percent growth versus 13 percent last quarter.

Bond Market Seeks Shelter Amid Uncertainty

U.S. Treasury bonds remain a refuge for cautious investors, though returns are modest. The yield on ten-year notes held near 4.41 percent. Fed funds futures saw slight gains, reflecting modest expectations for policy easing next year.

Fed Faces Crosswinds from Politics

Federal Reserve Chair Jerome Powell continues to advocate for a patient approach to rate cuts. However, former president Donald Trump is turning up the heat, calling for more aggressive economic stimulus. Over the weekend, White House economic advisor Kevin Hassett suggested Powell's tenure could be at risk over excessive spending on the renovation of the Fed's Washington headquarters.

Currencies Drift Lower on Trade Concerns

In currency markets, the euro dipped by 0.1 percent to 1.1675, pulling back from a recent four-year high near 1.1830. The dollar weakened slightly against the yen to 147.35, while its broader index held near 97.882, showing minimal change.

Dollar Gains as Mexico Eyes Trade Deal

The US dollar rose by 0.3 percent against the Mexican peso, reaching 18.6730. The move followed Mexican President Claudia Sheinbaum's statement expressing optimism that a trade agreement with the United States could be finalized before the August deadline.

Bitcoin Hits Uncharted Territory

Bitcoin broke new ground, surpassing the 120 thousand dollar mark for the first time ever and peaking at 121207 dollars and 55 cents. The cryptocurrency continues its impressive upward trajectory.

Gold Holds Its Role as a Safe Haven

Gold edged higher by 0.1 percent to reach 3359 dollars per ounce, as investors continued to seek refuge in the precious metal amid ongoing global uncertainty.

Oil Prices Edge Up Slightly

Crude markets saw mild gains. Brent crude rose by 0.2 percent to 70 dollars and 49 cents a barrel, while US West Texas Intermediate crude climbed by 0.1 percent to trade at 68 dollars and 55 cents.

European Stocks Retreat on Trade Worries

European shares opened the week with declines, driven by renewed threats from former president Donald Trump to impose fresh tariffs on imports from both the EU and Mexico. The automotive sector was hit particularly hard.

STOXX 600 Declines, FTSE 100 Bucks the Trend

The pan-European STOXX 600 index slipped by 0.6 percent to 544.3 points. Most regional benchmarks followed suit, though the UK's FTSE 100 stood out with a 0.2 percent gain.

Automakers and Retail Under Pressure

European auto stocks lost 1.4 percent, while retail names fell by 1 percent. Both sectors are seen as particularly vulnerable to potential disruptions in international trade.

AstraZeneca Shares Climb on Drug Trial Success

In contrast to the broader market downturn, AstraZeneca shares rose by 1.9 percent. The pharmaceutical giant reported that its hypertension drug Baxdrostat met both primary and secondary targets in a late-stage trial among patients with treatment-resistant high blood pressure.