signal strength 1 of 5

On the chart of the USDJPY M5 trading instrument, the Triple Top pattern that signals a trend change has formed. It is possible that after formation of the third peak, the price will try to break through the resistance level 144.07, where we advise to open a trading position for sale. Take profit is the projection of the pattern’s width, which is 21 points.

The M5 and M15 time frames may have more false entry points.

See Also

- All

- Double Top

- Flag

- Head and Shoulders

- Pennant

- Rectangle

- Triangle

- Triple top

- All

- #AAPL

- #AMZN

- #Bitcoin

- #EBAY

- #FB

- #GOOG

- #INTC

- #KO

- #MA

- #MCD

- #MSFT

- #NTDOY

- #PEP

- #TSLA

- #TWTR

- AUDCAD

- AUDCHF

- AUDJPY

- AUDUSD

- EURCAD

- EURCHF

- EURGBP

- EURJPY

- EURNZD

- EURRUB

- EURUSD

- GBPAUD

- GBPCHF

- GBPJPY

- GBPUSD

- GOLD

- NZDCAD

- NZDCHF

- NZDJPY

- NZDUSD

- SILVER

- USDCAD

- USDCHF

- USDJPY

- USDRUB

- All

- M5

- M15

- M30

- H1

- D1

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

According to the chart of M15, AUDJPY formed the Head and Shoulders pattern. The Head’s top is set at 98.12 while the median line of the Neck is found

The M5 and M15 time frames may have more false entry points.

Open chart in a new windowThe Bullish pennant graphic pattern has formed on the #TSLA M5 instrument. This pattern type falls under the category of continuation patterns. In this case, if the quote can breaks

The M5 and M15 time frames may have more false entry points.

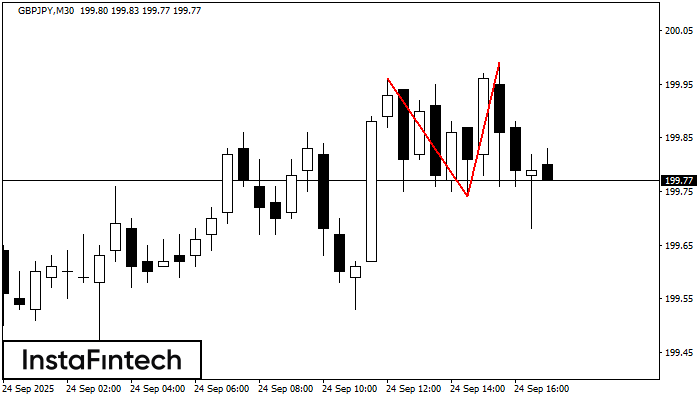

Open chart in a new windowThe Double Top reversal pattern has been formed on GBPJPY M30. Characteristics: the upper boundary 199.96; the lower boundary 199.74; the width of the pattern is 25 points. Sell trades

Open chart in a new window