Trade Review and Tips for Trading the British Pound

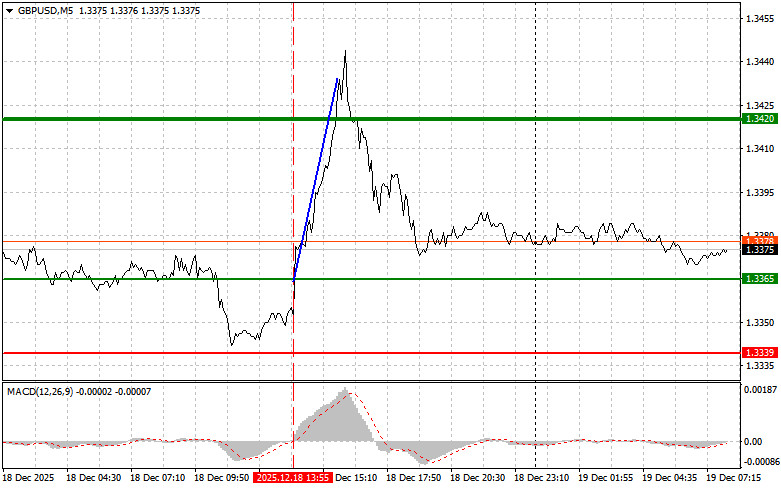

The test of the price at 1.3365 coincided with the MACD indicator just starting to move upwards from the zero mark, confirming the correct entry point for buying the pound. As a result, the pair rose by 40 pips.

The pound increased yesterday after the Bank of England lowered interest rates but warned that the speed and scale of future cuts are now in question. This decision, made against a backdrop of conflicting economic signals, left markets in uncertainty and increased volatility in the British currency. On one hand, the rate cut is intended to stimulate economic activity by easing the burden of borrowing for businesses and consumers. On the other hand, the BoE expressed concerns about the sustainability of inflation and emphasized that further steps will depend on incoming economic data.

This morning, reports reflecting the dynamics of retail sales in the United Kingdom and information on the volume of net borrowing in the public sector are expected to be published. These macroeconomic indicators can provide important insights into the health of the British economy and outline potential directions for its development. Retail trade dynamics, as an important indicator of consumer spending, show how actively citizens are purchasing goods and services. If retail sales are growing, which economists expect, the pound may respond with an upward movement. The volume of net borrowing in the UK public sector reflects the difference between government revenues and expenditures. An increase in borrowing may indicate the need to finance a budget deficit, which, in turn, can affect public finances and increase the debt burden. Conversely, a reduction in borrowing points to an improvement in the government's financial position and the possibility of reducing debt pressure.

Regarding the intraday strategy, I will primarily rely on implementing Scenarios #1 and #2.

Buy Scenarios

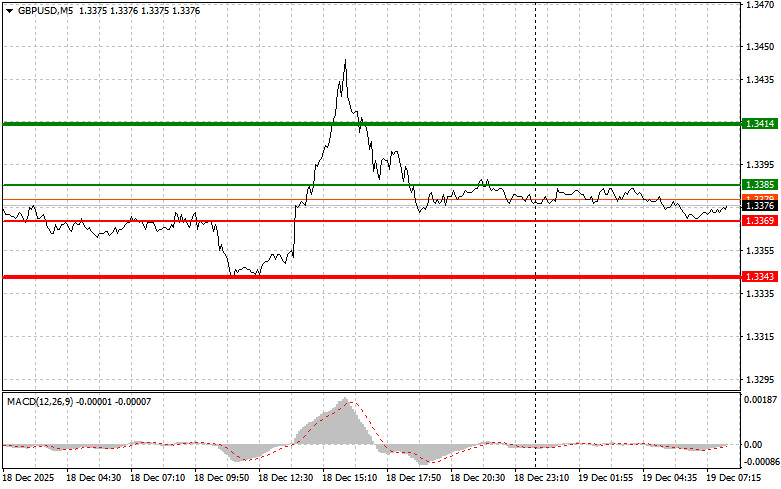

- Scenario #1: I plan to buy the pound today when it reaches the entry point around 1.3385 (green line on the chart), with a target for growth to 1.3414 (thicker green line on the chart). At approximately 1.3414, I plan to exit my long positions and open short positions in the opposite direction (anticipating a movement of 30-35 pips back from the level). A strong rise in the pound can only be expected after good data. Important! Before buying, ensure the MACD indicator is above the zero mark and just starting to rise from it.

- Scenario #2: I also plan to buy the pound today if the price tests 1.3369 twice in a row, at which point the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a market reversal upwards. A rise to the opposing levels of 1.3385 and 1.3414 can be expected.

Sell Scenarios

- Scenario #1: I plan to sell the pound today after the 1.3369 level is updated (red line on the chart), which will trigger a rapid decline in the pair. The key target for sellers will be the 1.3343 level, where I plan to exit my shorts and immediately buy in the opposite direction (anticipating a move of 20-25 pips back from that level). Sellers of the pound will return with weak data. Important! Before selling, ensure that the MACD indicator is below the zero mark and is just starting to decline from it.

- Scenario #2: I also plan to sell the pound today if the price tests 1.3385 twice in a row while the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downwards. A decline to opposing levels of 1.3369 and 1.3343 can be expected.

Chart Overview:

- Thin Green Line – entry price for buying the trading instrument;

- Thick Green Line – indicative price level for placing Take Profit or locking in profits, as further growth above this level is unlikely;

- Thin Red Line – entry price for selling the trading instrument;

- Thick Red Line – indicative price level for placing Take Profit or locking in profits, as further decline below this level is unlikely;

- MACD Indicator – when entering the market, it is important to be guided by overbought and oversold zones.

Important: Beginner traders in the Forex market should be very cautious when making entry decisions. It is best to avoid the market before the release of important fundamental reports to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. Without stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade in large volumes.

Remember that successful trading requires a clear trading plan, similar to the one presented above. Making spontaneous trading decisions based on the current market situation is inherently a losing strategy for an intraday trader.