Разбор макроэкономических отчетов:

Макроэкономических публикаций на среду не запланировано ни одного. В последние два дня мы наблюдали внушительное ралли по евро и фунту, обусловленное новым падением доллара. Однако вчера волатильность начала снижаться (особенно по евровалюте), поэтому сегодня (если не поступит новых резонансных сообщений) рынок может взять паузу. И евро, и фунт обновили свои 3-летние максимумы и в целом готовы продолжать рост против доллара. Конфликт на Ближнем Востоке несколько раз оказывал поддержку доллару в последние две недели, но даже с его помощью американская валюта не смогла показать существенный рост. Выступления Джерома Пауэлла, Кристин Лагард и Эндрю Бейли на этой неделе не дали никакой новой информации.

Разбор фундаментальных событий:

Из фундаментальных событий среды можно отметить только второе выступление Джерома Пауэлла в Конгрессе США. Напомним, что вчера состоялось первое, в ходе которого глава ФРС просто повторил все тезисы, которые уже давным-давно известны рынку. Ключевая ставка не будет снижаться в ближайшее время, регулятор ожидает полного проявления воздействия новой торговой политики США на экономику, регулятор ожидает всплеска инфляции. Сегодня господин Пауэлл вряд ли сообщит что-либо новое.

Для рынка на первом месте по степени значимости находится торговая война, признаков завершения которой пока не видно. Практически все последние события так или иначе оказывали давление на американскую валюту. Доллар мог бы рассчитывать на поддержку на фоне противостояния Израиля и Ирана, однако из этого события он извлек все дивиденды, которые мог. Если рынок не считает доллар «безопасным активом», то даже в условиях геополитической напряженности валюта не будет дорожать.

Советуем ознакомиться с другими статьями автора:

Обзор пары EUR/USD. 25 июня. Почему снова упал доллар?

Обзор пары GBP/USD. 25 июня. Трамп снова «проехался катком» по ФРС и Пауэллу.

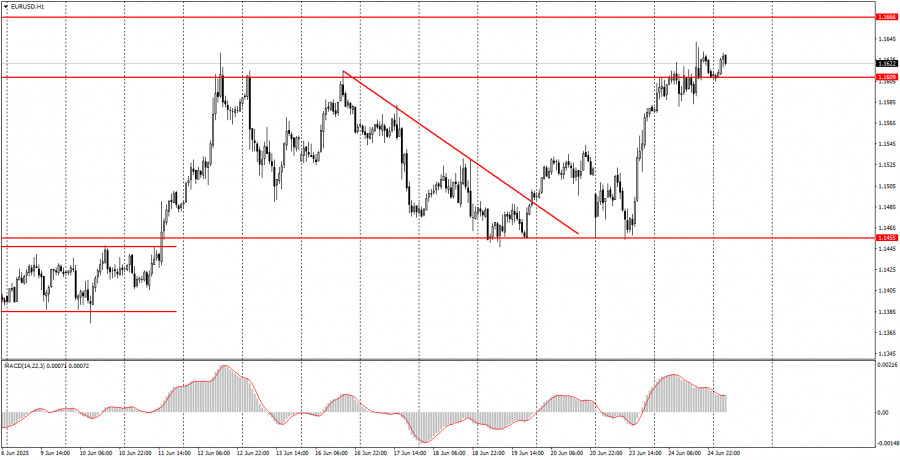

Торговые рекомендации и разбор сделок по EUR/USD на 25 июня.

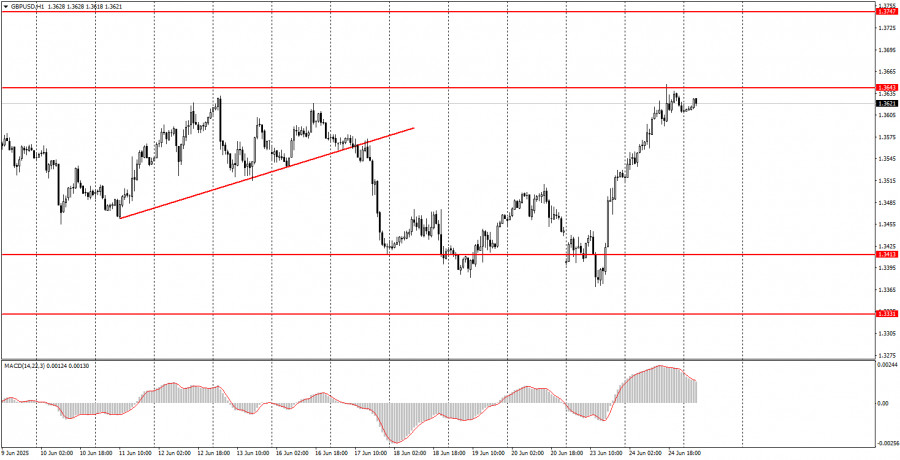

Торговые рекомендации и разбор сделок по GBP/USD на 25 июня.

Общие выводы:

В течение третьего торгового дня недели обе валютные пары могут продолжать расти, так как война на Ближнем Востоке завершена, а Мировая торговая война продолжается. В ближайшее время станет известно, подпишут ли Штаты торговую сделку хотя бы с кем-то, помимо Великобритании. Нас ждет множество интересных событий, но сегодня календарь новостей пуст.

Основные правила торговой системы:

1. Сила сигнала считается по времени, которое потребовалось на формирование сигнала (отскок или преодоление уровня). Чем меньше времени потребовалось, тем сильнее сигнал.

2. Если около какого-либо уровня были открыты две или больше сделки по ложным сигналам, то все последующие сигналы от этого уровня следует игнорировать.

3. Во флэте любая пара может формировать массу ложных сигналов или же не формировать их вовсе. Но в любом случае при первых признаках флэта лучше переставать торговать.

4. Торговые сделки открываются во временной период между началом европейской сессии и до середины американской, когда все сделки должны быть закрыты вручную.

5. На 30-минутном ТФ по сигналам от индикатора MACD можно торговать только при наличие хорошей волатильности и тренда, который подтверждается линией тренда или трендовым каналом.

6. Если два уровня расположены слишком близко друг к другу (от 5 до 20 пунктов), то следует рассматривать их как область поддержки или сопротивления.

7. При прохождении цены после открытия сделки в верном направлении 15-20 пунктов следует выставлять Stop-Loss в безубыток.

Что на графике:

Ценовые уровни поддержки и сопротивления – уровни, которые являются целями при открытии покупок или продаж. Около них можно размещать уровни Take Profit;

Красные линии – каналы или линии тренда, которые отображают текущую тенденцию и показывают, в какую сторону предпочтительно сейчас торговать;

Индикатор MACD (14, 22 ,3) – гистограмма и сигнальная линия – вспомогательный индикатор, который также можно использовать в качестве источника сигналов.

Важные выступления и отчеты (всегда содержатся в календаре новостей) могут очень сильно влиять на движение валютной пары. Поэтому во время их выхода рекомендуется торговать максимально осторожно или выходить из рынка во избежание резкого разворота цены против предшествующего движения.

Начинающим торговать на рынке Форекс следует помнить, что каждая сделка не может быть прибыльной. Выработка четкой стратегии и мани-менеджмент являются залогом успеха в трейдинге на длительном промежутке времени.