S&P 500 and Nasdaq hit new highs amid AI enthusiasm

Thursday's session ended with record closes for the S&P 500 and Nasdaq. Investor optimism was fueled by strong earnings from Alphabet, boosting appetite for other leading tech names linked to artificial intelligence development. Tesla, however, underperformed following disappointing earnings, reflecting market unease.

Alphabet lifts market, Tesla dissapoints

Alphabet shares rose 1% after the tech giant's executives expressed confidence in the effectiveness of their AI investments, citing early significant returns from major capital outlays.

In contrast, Tesla failed to impress. Weak financial results pushed its stock lower, signaling investor disappointment.

UnitedHealth and IBM under pressure

UnitedHealth shares plunged nearly 5% after the company said it is cooperating with the US Justice Department in a probe into its Medicare programs. The disclosure came as new criminal and civil investigations emerged.

IBM shares fell even more, down almost 8%, as its Q2 report failed to reassure investors. The decline was driven by weakening sales in its core software division.

Honeywell slips despite upbeat outlook

Honeywell beat analyst estimates and raised its full-year guidance. Still, shares dropped more than 6%, surprising investors despite the upbeat earnings news.

Closing numbers

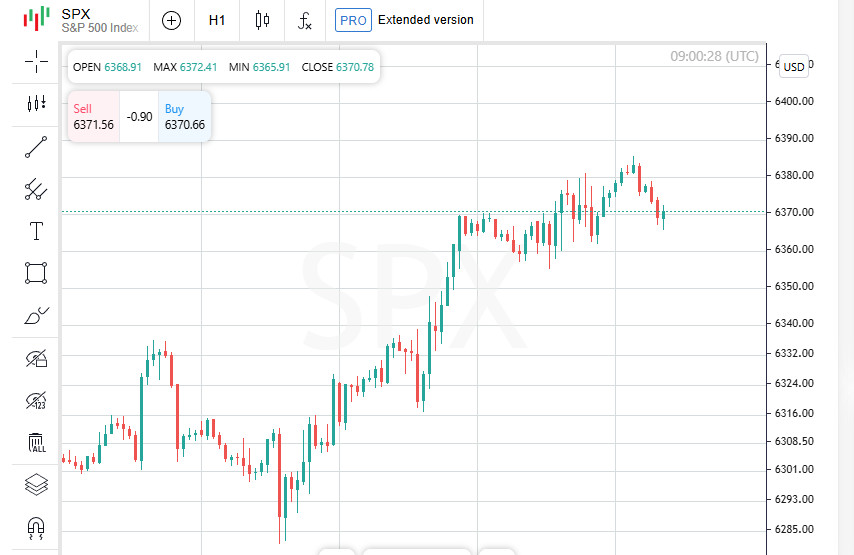

At the end of the session, the S&P 500 gained 0.07%, closing at 6,363.35. The Nasdaq rose 0.18%, finishing at 21,057.96. The Dow Jones declined 0.70%, falling to 44,693.91.

American Airlines nosedives

Shares of American Airlines came under heavy pressure, plunging nearly 10%. The sharp decline followed bleak guidance from management for the third quarter. The company warned of significant losses driven by weakening demand for domestic travel.

Sector in limbo: trade wars and new risks

The airline industry continues to face unprecedented uncertainty, reminiscent of the pandemic-era turbulence. This is due to global trade conflicts stoked by US President Donald Trump, which have already disrupted established patterns in the sector.

Trump and FOMC: shifting expectations

The financial community closely monitored Trump's visit to the Federal Reserve's headquarters. The president has repeatedly criticized Fed Chair Jerome Powell, blaming him for keeping interest rates too high.

While most economists expect the Fed to hold interest rates steady at its upcoming meeting, CME Group's FedWatch tool now puts the probability of a rate cut in September at 60%.

Labor market remains resilient

A fresh report from the US Labor Department added a dose of optimism — initial jobless claims fell to 217,000, significantly better than forecasts. The data signals continued strength in the labor market.

Inflation enters new phase

US business activity accelerated in July. However, companies raised prices on goods and services, aligning with analyst expectations. The inflationary push is tied to growing import costs, adding new pressure to consumer prices.

European markets in red ahead of US trade developments

On Friday, European equities declined as investors awaited key announcements on EU-US trade relations. The auto sector was hit particularly hard. Nervous investors are watching closely as the White House is expected to announce a deadline for new import tariffs as early as next week.

STOXX 600 dips after hitting six-week high

By Friday morning, the pan-European STOXX 600 index had dropped 0.6%, settling at 548.16 points. The pullback followed Thursday's 1.5-month high. Despite the retreat, the index remains in positive territory for the week.

UK market retreats from record

The UK's FTSE 100 index also posted a decline of 0.4%, pulling back from its all-time high reached on Thursday. Similarly, most regional exchanges ended the morning in negative territory.

Auto sector under pressure: top decliners

European carmakers were among the hardest hit. The sector-specific index dropped 1.4%, led by a sharp sell-off in French auto parts maker Valeo. Its shares tumbled 12.4% after the company downgraded its annual sales forecast, falling short of expectations.

Volkswagen and Traton adjust forecasts

Shares of Volkswagen, Europe's largest automaker, slipped 2.4% after the company revised its outlook amid renewed tariff concerns. Traton, Volkswagen's truck division, came under even heavier pressure, with shares sliding 8.1% following a downgrade of its own guidance.

Puma suffers brutal sell-off

The steepest decline among major stocks came from Puma. Shares of the German sportswear giant plunged 18.7% after the company cut its full-year forecast and reported weak quarterly results.

Week of talks and new agreements

Despite elevated volatility and prevailing negative sentiment, investors welcomed trade deals with Japan, Indonesia, and the Philippines. Optimism also persists around a potential agreement between the US and the European Union, with negotiations still ongoing.