On Tuesday, the EUR/USD currency pair maintained the beginning of a new leg of its upward trend. A day earlier, the price had consolidated above the moving average line, which is a reason in itself to expect further appreciation of the euro. It's worth noting that over the past six months, the euro has been a silent observer of its growth—growth it hasn't seen in 15 years. If we try to list the reasons for the euro's rise today, we would come up empty, because the euro is rising solely due to the weakening of the U.S. dollar. Since the euro is the second most important currency in the world, dollar sell-offs result in most capital flowing into the euro. This capital shift is what has fueled the euro's six-month rally.

Many analysts remain skeptical about the euro's continued growth and the dollar's ongoing decline. Of course, in the market, opinions are as numerous as participants, and we're not claiming these experts are wrong. However, in our view, the global situation is deteriorating by the day—there's no better way to put it. The pressure factors on the dollar aren't just persisting—they're growing. Whereas Donald Trump previously limited himself to insulting Jerome Powell and calling for his resignation, he has now launched a whole campaign to discredit the Federal Chair. Powell is now being painted as a financial fraudster, a spendthrift, and a liar—accusations serious enough to land an official in court.

Previously, Trump threatened new trade tariffs. Now, he's ready to raise them daily. Despite the fast-approaching August 1 deadline—by which negotiating parties should be striving to reach a consensus—we see quite the opposite in practice: Washington continues to issue ultimatums, make threats, and raise tariffs. This is particularly true regarding the European Union, with which a trade deal is allegedly "about to be signed," according to Trump himself.

This brings to mind the fact that for three months now, Trump has been promising numerous beneficial and brilliant agreements, yet only three have materialized. And we still don't understand whether the deal with China is finalized or if talks are ongoing. There's simply no information on who is involved in the negotiations or what stage they're at. The market is left guessing. The bits of information that do reach the media are either rumors, hoaxes, or leaks suggesting that no trade deals will be made with the EU, India, China, or any other major trade partners.

Perhaps we're being overly pessimistic, but what basis is there for believing that trade deals are close to being signed? Trump's words? We think graffiti on a fence is just as reliable. In short, if any deals do get signed—any at all—it will be a complete surprise. The tariffs will remain either way, and Trump considers it acceptable to talk about further tariff hikes on EU goods just a week before the deadline. The EU, for its part, is also prepared to respond. Do the parties genuinely want to reach common ground?

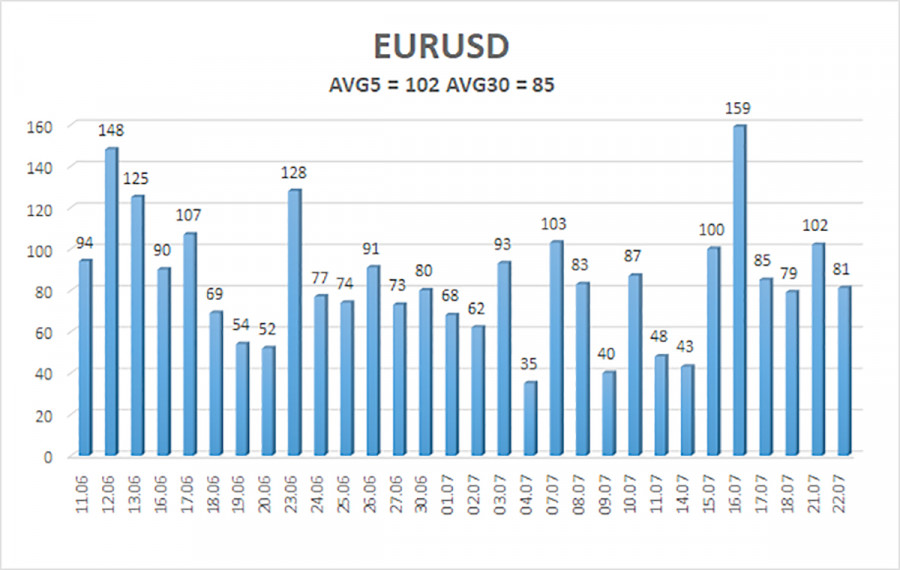

The average volatility of the EUR/USD pair over the past five trading days, as of July 23, stands at 102 pips, which is considered "high." We expect the pair to move between the levels of 1.1622 and 1.1856 on Wednesday. The long-term linear regression channel is pointing upward, still signaling an uptrend. The CCI indicator dipped into the oversold zone, which previously warned of a trend reversal to the upside.

Nearest Support Levels:

S1 – 1.1719

S2 – 1.1658

S3 – 1.1597

Nearest Resistance Levels:

R1 – 1.1780

R2 – 1.1841

Trading Recommendations:

The EUR/USD pair has resumed its uptrend. At the very least, the price has consolidated above the moving average and continues to move north. The U.S. dollar remains heavily impacted by Trump's policies—both domestic and foreign. In recent weeks, the dollar has seen a slight uptick, but in our view, it's still not a time for medium-term long positions on the greenback.

If the price falls below the moving average, short positions may be considered with targets at 1.1597 and 1.1536, based strictly on technical grounds. As long as the price remains above the moving average, long positions targeting 1.1780 and 1.1856 remain relevant, continuing the prevailing trend.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.