Wall Street records: tech giants drive market higher

The US stock indices S&P 500 and Nasdaq closed Monday at all-time highs. The reason was a surge in investor interest in tech leaders' stocks, especially ahead of second-quarter earnings releases. Market participants hope that potential trade agreements will help offset the economic impact of previously imposed tariffs by the Trump administration.

Alphabet sets pace for earnings seasonShares of Alphabet, the parent company of Google, jumped 2.7% on expectations for its quarterly report due Wednesday. Alongside Tesla, which is also set to report results on the same day, Alphabet kicks off the so-called Magnificent Seven earnings season. Their financial results could set the tone for the entire tech sector in the coming weeks.

Tesla dips slightly, while Apple and Amazon climbDespite the overall optimism, Tesla shares declined by 0.35%. Meanwhile, Apple rose by 0.62%, and Amazon gained 1.43%, providing additional support to the major indices.

Verizon surprises with forecast and ralliesVerizon shares climbed more than 4% after the telecom giant raised its full-year earnings expectations, a welcome surprise for investors.

Big tech betsAnalysts forecast that companies in the S&P 500 will post a 6.7% profit growth in the second quarter. According to estimates by LSEG I/B/E/S, the biggest contribution to this growth is expected to come from leading IT sector players.

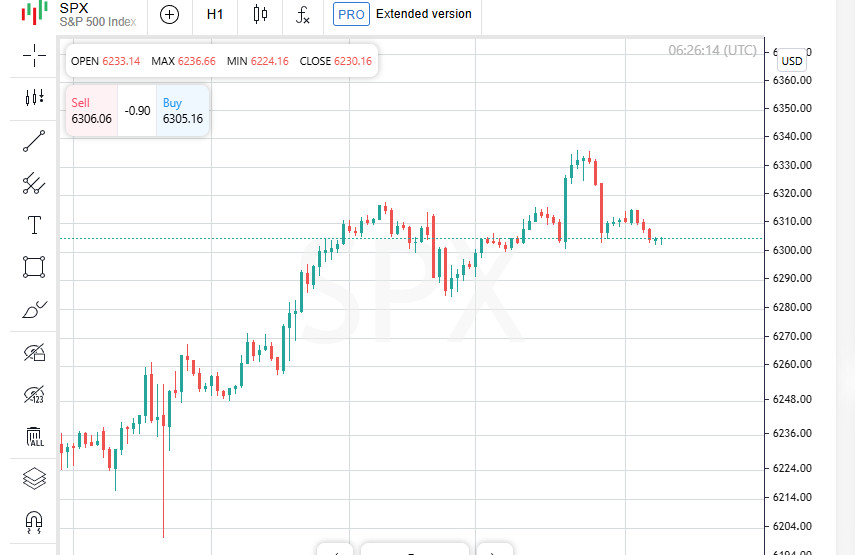

US market rises amid tariff hopesThe S&P 500 has gained around 8% year-to-date, supported by investor hopes that the impact of new trade tariffs will be less severe than previously feared. These hopes have intensified ahead of August 1, the deadline set by US President Donald Trump for implementing the tariffs.

Trump raises stakes in trade gameThe US president has ramped up pressure by threatening to impose 30-percent tariffs on products from Mexico and the European Union. Additional warnings were also issued to Canada, Japan, and Brazil about potential tariffs ranging from 20% to 50%. These moves have raised market concerns, but investors remain moderately optimistic for now.

Indices Show cautious gains, except DowThe S&P 500 rose 0.14%, ending the session at 6,305.60. Nasdaq posted a stronger gain of 0.38%, reaching 20,974.18 points. Meanwhile, the Dow Jones slipped slightly by 0.04%, closing at 44,323.07.

Communication and consumer sectors leadOut of the 11 sectors in the S&P 500 index, seven finished the day in the green. The communication services sector showed the highest growth, up 1.9%. The consumer sector also performed well, gaining 0.6%.

Japan stabilizes, USD under pressureIn Asian markets, Japan's Nikkei is climbing, supported by a decline in political tensions following elections. At the same time, the US dollar is weakening as market participants closely monitor developments on the tariff front. Additional concerns are emerging over possible threats to the Federal Reserve's independence.

Asian markets pause ahead of earnings wave and tariff uncertaintyAfter a confident rise to nearly a four-year high on Tuesday, Asian stock markets began to pull back. Investors are showing caution ahead of corporate earnings releases and the next phase of trade talks between the U.S. and key partners.

Europe awaits earnings; futures turn negativeEuropean exchanges also remain cautious. Anticipation of quarterly data from major companies like SAP and UniCredit is affecting the mood: EUROSTOXX 50 and DAX futures both fell by half a percent, while the UK's FTSE declined by 0.3%.

Asian index retreats from recordThe MSCI index for Asia-Pacific stocks excluding Japan hit a new high since October 2021 in the morning but later fell by 0.4%. Nevertheless, it still shows a solid year-to-date gain of about 16%.

US markets maintain momentumAmid global volatility, US exchanges are showing resilience. On Monday, the S&P 500 and Nasdaq closed at new historic peaks, confirming investor appetite for American assets.

Japan reacts to political changesAfter the weekend, Japan opened higher, but sentiment quickly shifted. Initially, the Nikkei index rose confidently, but declined in the second half of the day. The reason was shifting expectations following the upper house election, where the ruling coalition suffered a loss. Prime Minister Shigeru Ishiba stated he would not step down despite the setback.

Yen strengthens after weekly lossesOn the currency market, the Japanese yen rose by 1% on Monday, partially recovering recent losses. Later, its rate adjusted slightly to 147.73 yen per dollar.

Focus on tariff talks and EU reactionMarket focus is now on the tariff situation. As the August 1 deadline nears, the European Union is actively discussing potential countermeasures against the US. Hopes for a swift resolution are becoming increasingly faint.