The EUR/USD currency pair traded higher throughout Monday. The rise in quotes began early in the morning and persisted for most of the day. Despite the lack of fundamental or macroeconomic events yesterday, demand for the U.S. dollar began to decline, which we believe was a logical outcome.

Let us recall that in recent weeks, we repeatedly stated that the dollar had been rising solely on corrective, technical grounds. If we carefully examine the latest fundamental news, it's hard to understand why the dollar has been strengthening over the past three weeks at all. However, even the U.S. dollar, under Donald Trump, cannot fall endlessly. Therefore, occasional corrections are natural. One such correction is what we've seen over the past three weeks.

The technical correction may not be entirely over yet, but it has become increasingly difficult for the dollar to rise with each passing day. It's hard to grow when there's no support. We tend to believe that the market never really increased its demand for the U.S. currency. What we saw was simply the result of profit-taking on long EUR/USD positions.

What to expect next?

Of course, the dollar won't fall forever. However, if we examine the fundamental backdrop — the key driver of the dollar's decline this year — it's extremely difficult to discuss the strengthening of the U.S. currency. Sooner or later, traders will price in all the negative factors for the dollar. But how can one expect a rebound when, just in the past two weeks, Trump has raised tariffs on 25 countries from his "blacklist," announced new duties on medications and copper, and failed to sign a single trade deal?

Let us also remind you that by 2025, the monetary policies of the European Central Bank, the Bank of England, and the Federal Reserve will have little impact on traders. The Fed has kept its key rate unchanged since last year, while the BoE has eased it twice, and the ECB has done so four times. Has any of this affected the dollar's exchange rate? No. Because there is only one topic on the market's mind now — Trump's policies.

Moreover, whereas several months ago this meant just trade disputes with the rest of the world, today it also includes a direct confrontation with Jerome Powell. Recall that Trump is eagerly trying to fire Powell, believing that the Fed Chair is responsible for the slowing U.S. economy. Trump overlooks the fact that lowering interest rates requires a majority vote in the FOMC. And how can that be achieved if 10 out of 12 members support keeping rates unchanged, and the other two are just eyeing the Chair position?

Nevertheless, Trump believes that the Fed Chair should behave within his agency just as Trump behaves in the White House — simply giving orders, regardless of what the Constitution or the law says. That's why Trump keeps issuing directives that Powell simply doesn't follow. However, he has no obligation to do so. Given Powell's "audacity," Trump wants to remove him as quickly as possible. But he has no legal authority to do that either. And the market understands that if Trump gets his way, the Fed's independence will be at serious risk.

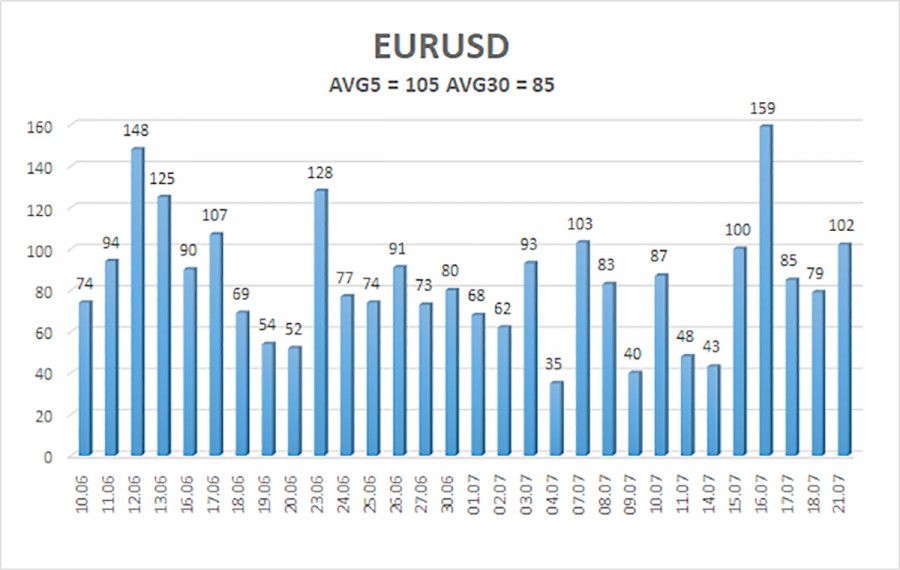

The average volatility of the EUR/USD currency pair over the last five trading days as of July 22 is 105 pips, which is characterized as "moderate." We expect the pair to move between the levels of 1.1589 and 1.1799 on Tuesday. The long-term linear regression channel is pointing upward, which still indicates a bullish trend. The CCI indicator entered the oversold zone, warning of a potential resumption of the uptrend.

Nearest Support Levels:

S1 – 1.1658

S2 – 1.1597

S3 – 1.1536

Nearest Resistance Levels:

R1 – 1.1719

R2 – 1.1780

R3 – 1.1841

Trading Recommendations:

The EUR/USD pair maintains its uptrend and may resume it in the coming days. At the very least, the price has already consolidated above the moving average. U.S. dollar weakness remains heavily influenced by Trump's domestic and foreign policy. While the dollar has seen a slight recovery in recent weeks, in our view, it is still too early to talk about medium-term buying opportunities. If the price is located below the moving average, small short positions targeting 1.1597 and 1.1536 can be considered on a purely technical basis. Above the moving average line, long positions remain relevant with targets at 1.1780 and 1.1799 in line with the ongoing trend.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.