Trade Review and Advice on Trading the British Pound

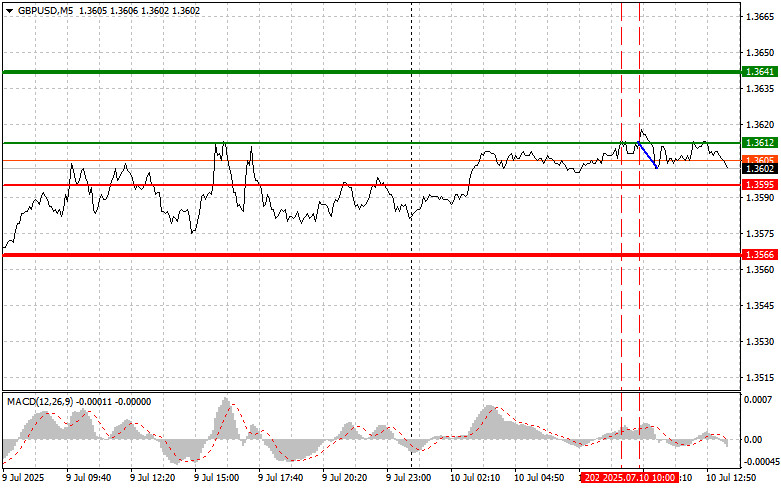

The test of the 1.3612 level occurred when the MACD indicator had already moved significantly above the zero line, which limited the pair's upward potential. A short time later, the price tested this level again, but by then the MACD was in overbought territory and starting to move back toward the zero line, enabling Sell Scenario #2. However, as you can see on the chart, no strong downward movement followed.

The absence of UK economic data weighed on the pound, while speeches from Bank of England officials had little impact on the GBP/USD pair. Investors were likely expecting more concrete signals regarding the future path of monetary policy, but instead received only general statements that failed to provide direction for the currency.

During the U.S. session, attention will be focused on weekly initial jobless claims data in the United States and on speeches from FOMC members Mary Daly and Christopher Waller, who is known for his dovish stance on interest rates. If Federal Reserve officials unexpectedly suggest delaying further policy easing, the dollar could strengthen against the pound. The market is closely watching for any signals from the FOMC, particularly amid ongoing economic uncertainty.

The jobless claims report will serve as an important indicator of the state of the U.S. labor market and will help assess the resilience of the recovery and the potential need for further stimulus. Any surprises could trigger sharp market reactions and increase volatility in currency pairs.

As for intraday strategy, I will continue to rely on the execution of Scenarios #1 and #2.

Buy Signal

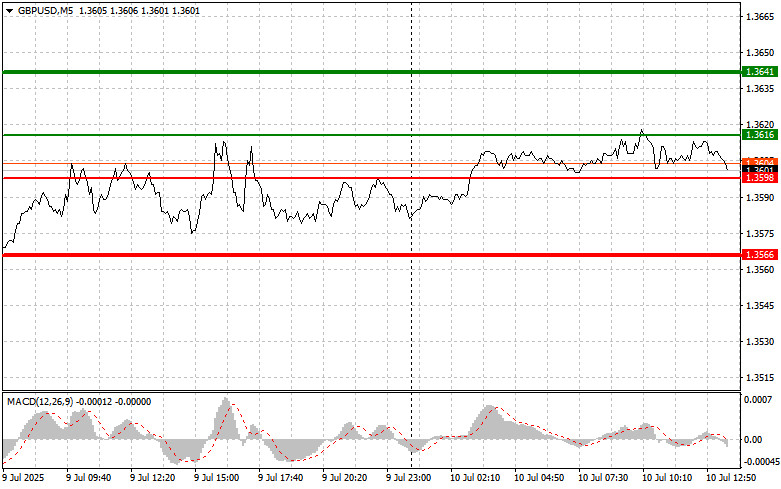

Scenario #1: I plan to buy the pound today after the price reaches the entry point around 1.3616 (green line on the chart), targeting a rise to 1.3641 (thicker green line). Near 1.3641, I will exit long positions and open short positions in the opposite direction (expecting a 30–35 point pullback). A stronger pound today is only likely if FOMC members take a dovish stance. Important! Before buying, make sure the MACD indicator is above the zero line and just beginning to rise.

Scenario #2: I also plan to buy the pound today if the price tests the 1.3598 level twice in a row, while the MACD is in oversold territory. This would limit the pair's downward potential and lead to a market reversal to the upside. A rise to the opposite levels of 1.3616 and 1.3641 may follow.

Sell Signal

Scenario #1: I plan to sell the pound after a break below the 1.3598 level (red line on the chart), which may lead to a quick decline. The key target for sellers will be 1.3566, where I will exit short positions and consider buying in the opposite direction (expecting a 20–25 point pullback). Sellers are likely to apply pressure if the U.S. data is strong. Important! Before selling, make sure the MACD indicator is below the zero line and just beginning to decline.

Scenario #2: I also plan to sell the pound if the price tests the 1.3616 level twice in a row, while the MACD is in overbought territory. This would limit the pair's upward potential and lead to a reversal downward. A decline toward the opposite levels of 1.3598 and 1.3566 may follow.

Chart Legend:

- Thin green line – entry price for buying the trading instrument

- Thick green line – approximate level to set Take Profit or manually secure profits, as further growth above this level is unlikely

- Thin red line – entry price for selling the trading instrument

- Thick red line – approximate level to set Take Profit or manually secure profits, as further decline below this level is unlikely

- MACD Indicator – overbought and oversold zones should be used as signals when entering the market

Important Note for Beginners:

Beginner traders in the Forex market must make entry decisions with extreme caution. It's best to stay out of the market before major fundamental releases to avoid getting caught in sharp price swings. If you choose to trade during news events, always use stop-loss orders to limit potential losses. Trading without stop-losses can quickly lead to a full loss of your deposit, especially if you ignore money management and use large trade sizes.

And remember, successful trading requires a clear trading plan—such as the one I presented above. Making spontaneous trading decisions based on the current market situation is inherently a losing strategy for an intraday trader.