Trade Analysis and Trading Tips for the British Pound

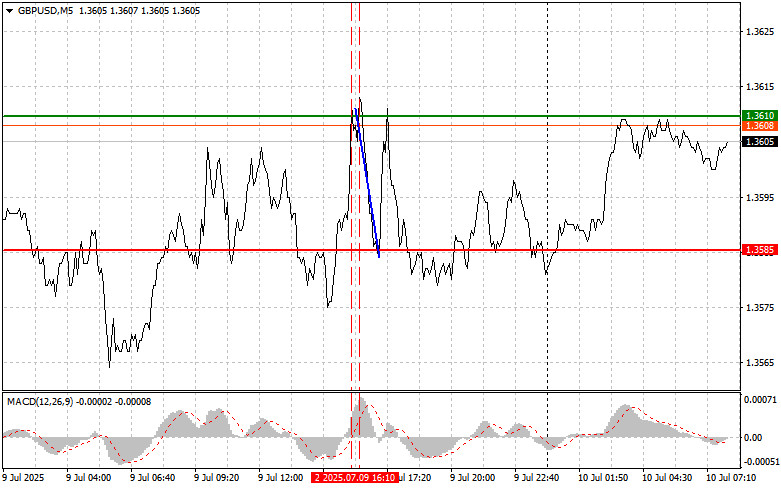

The test of the 1.3610 price level coincided with a moment when the MACD indicator had already moved significantly above the zero line, which limited the pair's upward potential. A second test of 1.3610 shortly afterward occurred when the MACD was in the overbought zone, confirming the implementation of Sell Scenario #2 and resulting in a 25-point drop.

Despite reduced pressure on the British pound, the outlook for GBP/USD remains uncertain. The FOMC minutes released yesterday revealed internal divisions: some participants believe that the tariffs will only cause a temporary spike in prices without affecting long-term inflation. However, most Fed officials expressed concern that the inflationary impact of tariffs could be more persistent. This detail underscores ongoing worries about inflation resilience in the U.S., which continues to support the dollar and weigh on the pound.

At the same time, the situation in the UK offers little optimism for the pound. The country's economic outlook remains unclear, and inflation is still high. The Bank of England will likely continue cutting interest rates, but the pace is expected to be gradual.

There are no economic reports scheduled for the UK today. Only a speech by Sarah Breeden, a member of the Bank of England's Financial Policy Committee, is expected. Her remarks will likely address the current macroeconomic situation and financial stability risks. Given the uncertainty surrounding the UK economy, her comments could significantly influence the pound's exchange rate. The market will closely examine her statements for clues about the Bank of England's future policy. If she expresses concern about inflation or suggests the need for a tighter monetary stance, the pound could receive support. On the other hand, if she emphasizes risks to economic growth or signals a more cautious approach, the pound may come under pressure.

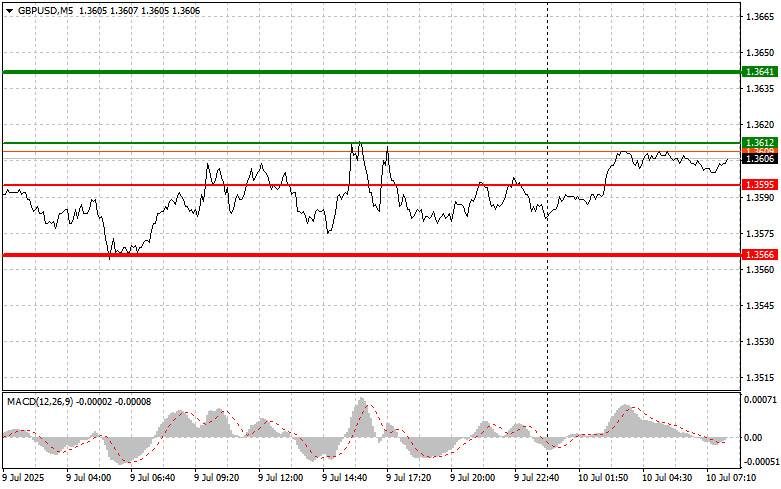

As for today's intraday strategy, I will continue to rely on implementing Scenarios #1 and #2.

Buy Scenarios

Scenario #1: I plan to buy the pound today upon reaching the entry point around 1.3612 (green line on the chart), targeting a rise to 1.3641 (thicker green line on the chart). Around 1.3641, I intend to exit long positions and open shorts in the opposite direction, aiming for a 30–35 point pullback. Any growth in the pound today is likely to be within a correction. Important! Before buying, make sure the MACD indicator is above the zero line and just beginning to rise from it.

Scenario #2: I also plan to buy the pound if there are two consecutive tests of the 1.3595 level while the MACD is in the oversold zone. This would limit the pair's downward potential and could trigger an upward reversal. In this case, we can expect a rise to the opposite levels of 1.3612 and 1.3641.

Sell Scenarios

Scenario #1: I plan to sell the pound after a breakout below 1.3595 (red line on the chart), which should lead to a quick drop. The main target for sellers will be 1.3566, where I plan to exit shorts and open long positions in the opposite direction, aiming for a 20–25 point bounce. Selling the pound can be considered on price increases, in continuation of the bearish trend. Important! Before selling, ensure the MACD indicator is below the zero line and just beginning to move downward from it.

Scenario #2: I also plan to sell the pound if there are two consecutive tests of the 1.3612 level while the MACD is in the overbought zone. This would limit the pair's upward potential and could trigger a downward reversal. In this case, we can expect a decline to 1.3595 and 1.3566.

Chart Explanation

- Thin green line – entry price for buying the trading instrument.

- Thick green line – suggested price for taking profit, as further growth above this level is unlikely.

- Thin red line – entry price for selling the trading instrument.

- Thick red line – suggested price for taking profit, as further decline below this level is unlikely.

- MACD Indicator – consider overbought and oversold zones when entering trades.

Important: Beginner Forex traders must approach market entries with great caution. It is best to stay out of the market before important fundamental reports are released to avoid sharp price movements. If you choose to trade during news releases, always use stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit—especially if you don't apply proper money management and trade large volumes.

And remember: successful trading requires a clear plan like the one above. Making spontaneous decisions based on short-term market movements is a losing strategy for an intraday trader.