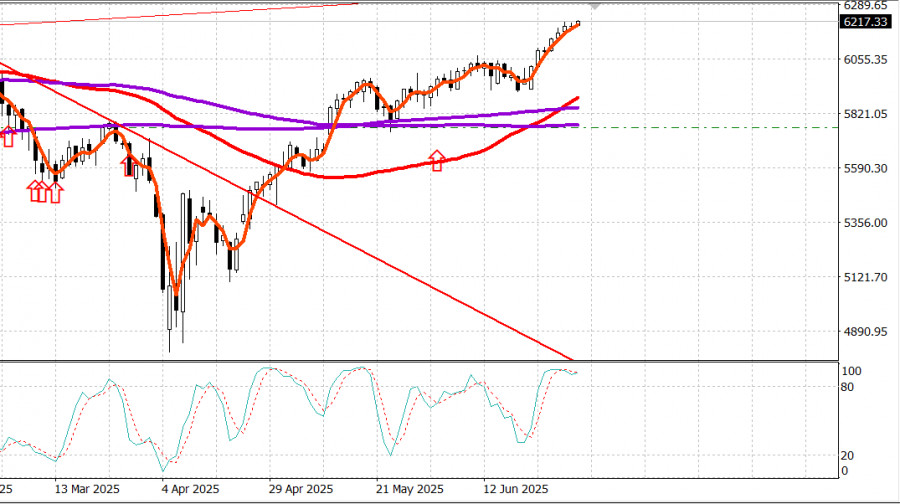

S&P 500

Overview on July 2

US market: bulls hold their ground, broader market leads

The main US indices on Tuesday: Dow +0.9%, NASDAQ -0.8%, S&P 500 -0.1%.

S&P 500: 6,198, trading range: 5,700-6,300.

Yesterday was the first trading day of the third quarter, and the broader market took the lead.

Small-cap stocks, mid-cap stocks, value stocks, and the "other 493" stocks in the S&P 500 occupied leading positions, while many of the mega-cap and growth stocks fell out of yesterday's advance.

The tape reflected rebalancing activity across the equity market. These efforts were supported by some optimism about growth prospects stemming from the JOLTS report showing a significant increase in job openings in May, the ISM Manufacturing Index showing a slower pace of contraction in June, and the Senate passing its version of the "One Big, Beautiful Bill" by a 51-50 vote decided by Vice President Vance casting the tie-breaking vote.

This bill was sent back to the House of Representatives, which will begin debate at 9:00 a.m. ET on Wednesday, according to a statement from House Majority Whip Emmer.

A vote will follow the end of debate, creating the possibility that the bill could be on the president's desk for signature by July 4.

The Treasury market received these and other developments with some reservations, believing that they could prevent a rate cut in July.

Other developments included a remark by Fed Chair Jerome Powell at the ECB Forum on Central Banking that the Fed likely would have already cut rates if not for the scale of announced tariffs, and a Bloomberg TV report that the president is not considering extending the tariff pause beyond July 9.

The president also speculated that the US is unlikely to strike a tariff deal with Japan.

The yield on 2-year Treasuries jumped five basis points to 3.77%, while the yield on the 10-year note rose just two basis points to 4.25% during trading that flattened the curve.

Yesterday's efforts to rebalance the equity market were evident in the outperformance of the equal-weight S&P 500 Index (+1.2%) compared to the market-cap-weighted S&P 500 (-0.1%), which came under pressure from losses in Tesla (TSLA 300.71, -16.95, -5.34%), NVIDIA (NVDA 153.29, -4.70, -2.97%), Meta Platforms (META 719.22, -18.87, -2.56%), Microsoft (MSFT 492.05, -5.36, -1.08%), and Alphabet (GOOG 176.91, -0.48, -0.27%).

Tesla's poor performance was compounded by concerns over Elon Musk's strong objections to the adoption of Trump's "One Big, Beautiful Bill" and the president's suggestion that the government might have to consider reducing subsidies for his companies.

Tesla's troubles did not weigh on the S&P 500 Consumer Discretionary sector (+0.2%), which was supported by gains in Amazon (AMZN 220.46, +1.07, +0.49%) and strong rallies in casino stocks after an encouraging June gross revenue report out of Macau.

The day's best-performing sectors were Materials (+2.3%), Health Care (+1.4%), Energy (+0.8%), and Consumer Staples (+0.8%).

The only two sectors posting losses were Communication Services (-1.2%) and Information Technology (-1.1%). The latter would have declined further were it not for the strength shown by Apple (AAPL 207.82, +2.65, +1.29%).

Breadth figures reflected broad buying interest beneath the surface of the index. Advancers led decliners by a 3-to-1 margin on the NYSE and about 5-to-4 on the Nasdaq.

Year-to-date performance:S&P 500: +5.4%Nasdaq: +4.6%DJIA: +4.5%S&P 400: +0.6%Russell 2000: -1.6%

Data recap:

The ISM Manufacturing Index rose to 49.0% in June (consensus 48.8%) from 48.5% in May.

The dividing line between expansion and contraction is 50.0%, so the June data indicate that activity in the manufacturing sector contracted at a slightly slower pace than the previous month.

The main takeaway from the report is that it has more of a stagflationary aura (the new orders index and employment index contracted at faster rates, while the prices index increased at a faster rate), which will make Fed policy discussions more complicated and the market's view of the Fed's thinking more frustrating.

Total construction spending fell by 0.3% month-over-month in May (consensus -0.2%) after a downwardly revised 0.2% decline (from -0.4%) in April.

Total private construction spending decreased by 0.5% month-over-month, while total public construction spending rose 0.1% month-over-month. Year-over-year, total construction spending declined by 3.5%.

The main conclusion from the report is the same as in the previous month: the decline in new single-family construction, pressured by higher costs, has become the driving force behind weakness in housing-related spending.

The number of job openings, JOLTS, increased to 7.769 million in May from an upwardly revised 7.395 million (from 7.391 million).

The rise in job openings indicates that the labor market is still in relatively firm shape, which could lead the Fed to refrain from cutting interest rates if inflationary pressures are not contained.

June S&P Global US Manufacturing PMI – Final (actual 52.9; prior 52.0)

Energy: Brent crude at $67.20, up about $0.50

Conclusion: The US market remains strong, so we recommend holding long positions. New long positions would be prudent only after a strong correction.