The GBP/USD currency pair traded sluggishly throughout Friday, but one technical factor is worth noting: the price failed to consolidate above the moving average. Thus, technical analysis currently suggests a potential decline. Overnight, the U.S. attacked key nuclear facilities in Iran—Fordow, Natanz, and Isfahan. Trump claimed they were completely destroyed and threatened to strike Iran's remaining nuclear sites if Tehran refuses to sign a peace agreement. This introduces another factor favoring the U.S. dollar: the deterioration of the global geopolitical situation.

Let's revisit some key points regarding potential Iranian actions in the region. First, Iran may retaliate against U.S. military bases, which could escalate the conflict significantly. Second, Iran might launch strikes against Israel, particularly since the Iron Dome has faced challenges in intercepting large-scale rocket attacks. Third, Iran has the potential to block the Strait of Hormuz, a crucial passageway through which approximately 20% of the world's daily seaborne oil supply flows. Finally, these developments could lead to a further increase in oil prices.

As previously mentioned, we do not expect a major rally in the U.S. dollar, but some strengthening this week is likely.

Let's return to the economy. Last week, both the Bank of England and the Federal Reserve held policy meetings, and the outcomes of these meetings favored the U.S. dollar. Jerome Powell reiterated that there is no need to lower the key interest rate—much to Trump's frustration. However, Trump still cannot sway Powell's stance. Moreover, Fed officials revised their dovish projections, now expecting only four rate cuts between 2025–2027, down from the previously projected six. This shift is supportive of the dollar.

The Bank of England's meeting was less impactful. The key event was the Monetary Policy Committee vote on a rate cut. The market expected only two members to vote for a cut, but three did. While this didn't affect the final decision, it signaled a more dovish outlook than anticipated.

At present, economic fundamentals have a weak impact on the forex market. The dollar continues to decline due to Trump's trade wars, global economic uncertainty, and protectionist rhetoric. Now, with Trump proving he's capable of taking bold military action, the situation has worsened. Geopolitical tensions in the Middle East could support the dollar in the near term, but what if Trump escalates even further—say, by claiming Greenland by force? Or continues to threaten half the world? We believe that the dollar has little chance of sustained strengthening in the medium term.

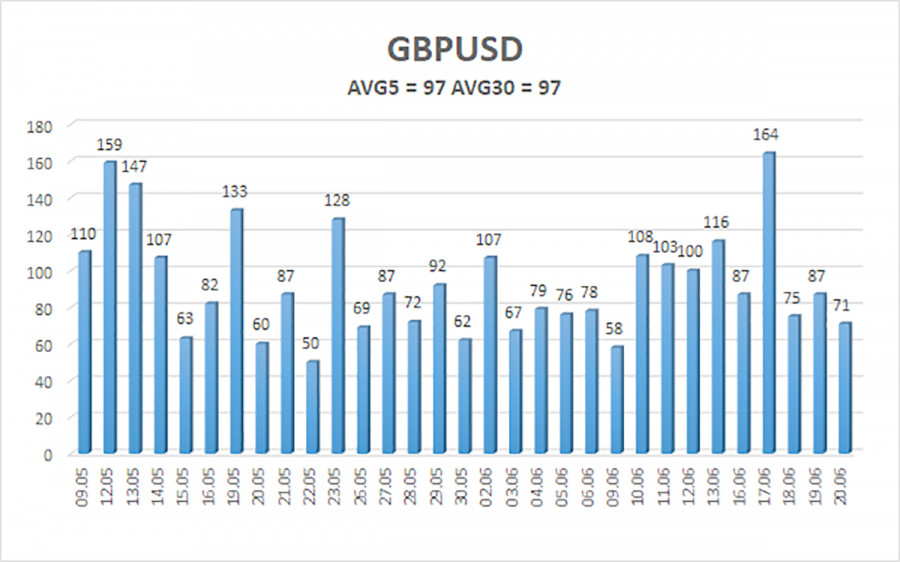

The average volatility of the GBP/USD pair over the last five trading days is 97 pips, which is considered "moderate" for this pair. On Monday, June 23, we expect movement from 1.3349 to 1.3543. The long-term regression channel points upward, indicating a clear long-term uptrend. The CCI indicator entered oversold territory this week, which could signal the resumption of upward movement.

Nearest Support Levels:

S1 – 1.3428

S2 – 1.3367

S3 – 1.3306

Nearest Resistance Levels:

R1 – 1.3489

R2 – 1.3550

R3 – 1.3611

Trading Recommendations:

The GBP/USD pair maintains an overall uptrend but is currently undergoing a correction. In the medium term, Trump's policies will likely continue to weigh on the dollar, but in the short term, geopolitical escalation in the Middle East may offer temporary support to the greenback. Long positions targeting 1.3611 and 1.3672 are valid if the price is above the moving average. Short positions with targets at 1.3367 and 1.3349 are appropriate if the price is below the moving average, supported by recent news. The U.S. dollar may occasionally show short-term corrections, but for a strong rally, it needs concrete signs that the global trade war is coming to an end.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.