Analysis of Wednesday's Trades

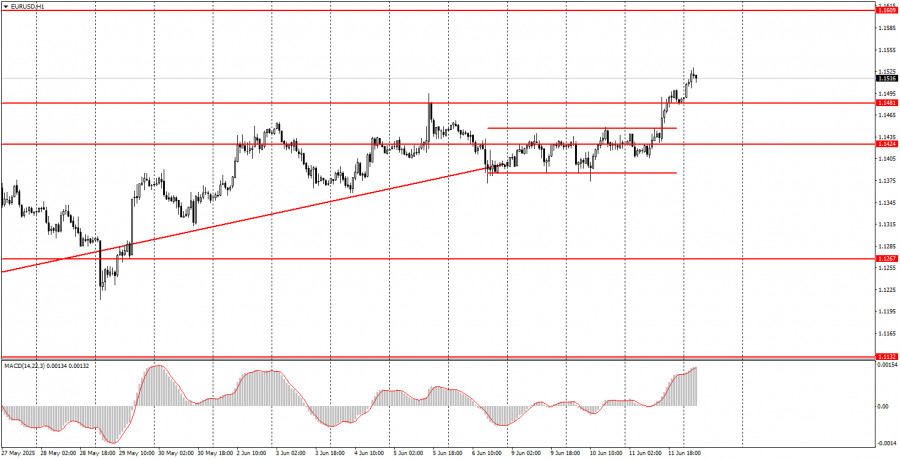

1H Chart of EUR/USD

On Wednesday, the EUR/USD currency pair resumed its upward trend, lasting more than four months. More precisely, it has continued since Donald Trump became president. As we can see, the pair rises sharply, corrects weakly, or consolidates within a range. This week, for example, the pair moved sideways in a narrow price range for 2.5 days before resuming its climb. Notably, the trigger for the dollar's new decline was relatively minor: a U.S. inflation report published yesterday came in 0.1% below expectations. Such a deviation is not enough to justify an 80-pip drop in the dollar. However, the issue isn't inflation, which currently has little influence on a Federal Reserve in pause mode. The real issue lies in the U.S., where mass protests against Trump continue, no trade deals have been signed, and relations with China and the EU remain tense. These broader fundamental factors continue to push the U.S. dollar deeper into decline.

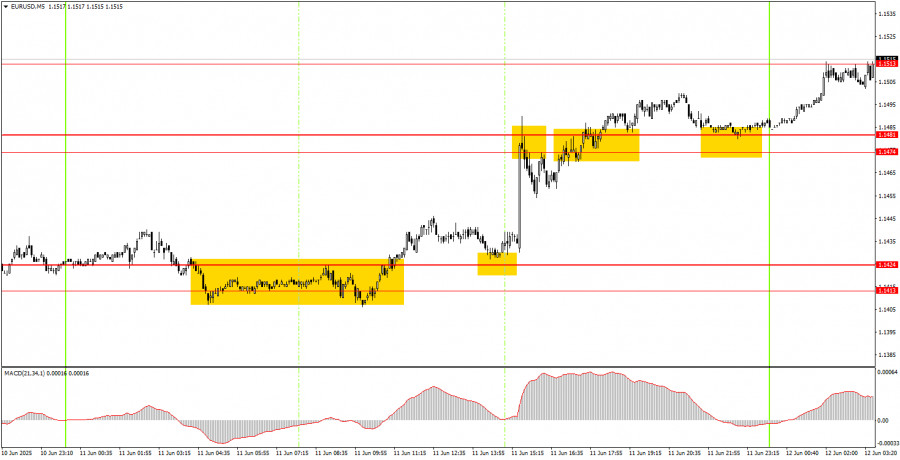

5M Chart of EUR/USD

On the 5-minute timeframe, several signals were generated on Wednesday, but the movements were choppy. Before the inflation report was released, the pair traded very calmly, then sharply jumped, followed by more stable price action. Two buy signals were generated during the European session and mirrored each other. This allowed novice traders to enter long positions before the rally. The price then quickly tested the 1.1474–1.1481 area but failed to break through, so long positions could have been closed in solid profit. A break above this zone would have allowed for new longs, and the euro continued to rise.

Trading Strategy for Thursday:

In the hourly timeframe, the EUR/USD pair has broken the ascending trendline, but the uptrend that began under Donald Trump remains intact. In principle, the fact that Trump is president is still enough for the market to continue selling the dollar. That alone is a strong reason for traders to flee the dollar without hesitation. Trump continues to issue threats, set ultimatums, impose or raise tariffs, and make other disruptive decisions. As a result, even if the market isn't selling the dollar daily, it certainly has no appetite to buy it either.

On Thursday, the EUR/USD pair will likely continue its upward movement, as no positive news is coming from the U.S. The market continues to look for any excuse to sell the dollar, only occasionally pausing briefly.

On the 5-minute timeframe, watch these key levels: 1.0940–1.0952, 1.1011, 1.1088, 1.1132–1.1140, 1.1198–1.1218, 1.1267–1.1292, 1.1354–1.1363, 1.1413–1.1424, 1.1474–1.1481, 1.1513, 1.1548, 1.1571, 1.1607–1.1622. No significant events are scheduled for either the EU or the U.S. on Thursday, but remember that mass protests and unrest continue in America.

Core Trading System Rules:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 15 pips in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.