The EUR/USD currency pair traded very calmly on Wednesday. As we mentioned yesterday, there was no reason to expect the business activity indices to influence trading — especially the European ones. Once again, the European macroeconomic backdrop had no impact, while the American data led to another drop in the dollar. However, the sluggish trading over the past few days doesn't mean the market has calmed down, and we won't see any more sharp moves. Just over the past week, there have been plenty of news items that could push the dollar to an even lower "bottom." This includes the failed attempt to cancel Trump's tariffs in court, renewed pressure on China and accusations against it, and increased tariffs on steel and aluminum imports — which took effect just yesterday. Now, tariffs on these metals are 50%. Canada, the EU, and other countries will unlikely leave Trump's move unanswered, as he is doing everything he can to protect domestic companies.

Unofficial sources indicated yesterday that Trump may soon increase pressure on the EU. Recall that earlier this month, Trump announced plans to raise tariffs for Europe to 50% on all goods but then eased up after talks with European Commission President Ursula von der Leyen. They agreed to engage in more active negotiations until July 9, which means Trump is waiting for a favorable trade offer.

We've often said that "justice according to Trump" is a particular concept. We are convinced Trump initiated the trade war specifically to pressure the EU and China. He wants either more money through imports from these countries or the removal of any restrictions and tariffs on American goods in European and Chinese markets — or likely both, without compromise.

Since negotiations with the EU have stalled again, the market expects Trump to play his trump cards. And he has plenty:

- Blackmail over Ukraine aid — Trump could threaten to cut U.S. financial support to Ukraine in its conflict with Russia. Clearly, the war is a much bigger problem for EU countries than for the U.S., safely across the ocean. If Washington pulls out, the financial burden will fall squarely on Brussels.

- NATO withdrawal — Trump could pull the U.S. out of NATO or at least withdraw U.S. troops from Europe. This would seriously weaken the EU's defense, which fears the conflict in Ukraine might not stay confined to Ukraine.

- Higher tariffs — If negotiations fail by July 9, Trump could raise tariffs on EU imports once again.

Thus, Trump has several ways to exert pressure on the European Union.

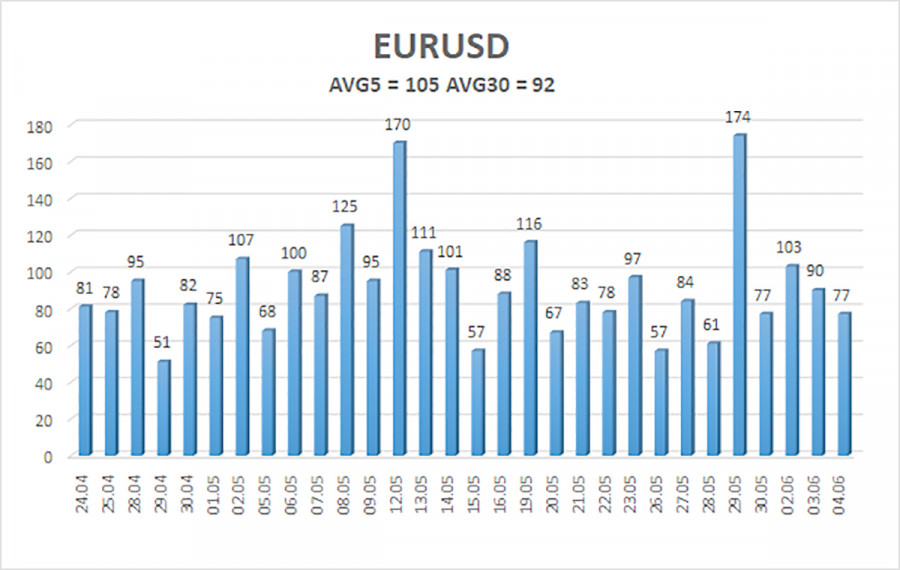

The average volatility of the EUR/USD currency pair over the last five trading days as of June 5 is 105 pips, categorized as "high." We expect the pair to move between the levels of 1.1320 and 1.1530 on Thursday. The long-term regression channel is still pointing upward, indicating a continuing uptrend. The CCI indicator dipped into the oversold area, and a bullish divergence formed, triggering a resumption of the uptrend.

Nearest Support Levels:

S1 – 1.1414

S2 – 1.1353

S3 – 1.1292

Nearest Resistance Levels:

R1 – 1.1475

R2 – 1.1536

R3 – 1.1597

Trading Recommendations:

The EUR/USD pair is attempting to resume its uptrend. In recent months, we've consistently said we expect only a decline for the euro in the medium term because the dollar still has no reason to fall — other than Donald Trump's policies, which will likely have destructive and long-lasting effects on the U.S. economy. However, we still observe the market's complete unwillingness to buy the dollar, even when reasons for doing so exist, and a complete disregard for any positive dollar factors.

If the price is below the moving average, short positions with targets at 1.1292 and 1.1230 are relevant, though a significant drop in the pair is not expected under current conditions. Above the moving average, long positions with targets at 1.1475 and 1.1530 can be considered.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.