The EUR/USD currency pair traded relatively calmly throughout Tuesday, and the U.S. dollar even managed to gain slightly. However, we wouldn't pay much attention to a dollar rise of a few dozen pips. The amount the American currency has lost in recent months speaks volumes about the prevailing sentiment among traders. Over these four months, there has been plenty of good news for the dollar. Yet the market, from the beginning of Donald Trump's presidency, started expecting the worst—and was mostly right. Trump immediately began accusing the world of unfairness and outright robbery of the United States, promising a bright future for Americans and the entire country. According to Trump, everything will be fine now because he is president again, and everything was bad before because Biden was in charge. Never mind that macroeconomic indicators suggest otherwise.

Trump (credit where it's due) is interested in more than just global trade architecture. He's concerned about many issues: the number of genders in the U.S., the fentanyl crisis, or the situation with legal and illegal immigrants. Of course, when speaking from a podium somewhere in Illinois about all these problems accumulated over years and decades, he gains voter support—because voters always believe politicians. Do they have another choice? Has there ever been a case in world history where no one showed up to vote, or the majority voted "against all"?

Thus, the only real question is which politician is more convincing in their promises and speeches before the election. Trump was compelling because he knows how to promise "golden mountains." Yet four months have passed, and the promised great future for the U.S. is not even on the horizon. The dollar is gradually losing its "global reserve currency" status, the American economy no longer attracts investors from around the world, and Trump has alienated most countries for years to come. Of course, this doesn't mean that there won't be any trade relations or cooperation between the U.S. and, say, Hungary. Business and money matter more than grudges. However, bigger players like Canada, Mexico, the European Union, and, of course, China will remember Trump's methods for a long time.

Perhaps Trump isn't the only one to blame; others are not entirely "pure and innocent." But from the outside, this is how it appears. We believe Trump's trade war primarily targets the EU and China, while other countries are just collateral damage. We don't believe that a deal with the UK (which doesn't even exist yet) will significantly boost the U.S. budget, which is measured in trillions of dollars. And no other trade deals have materialized.

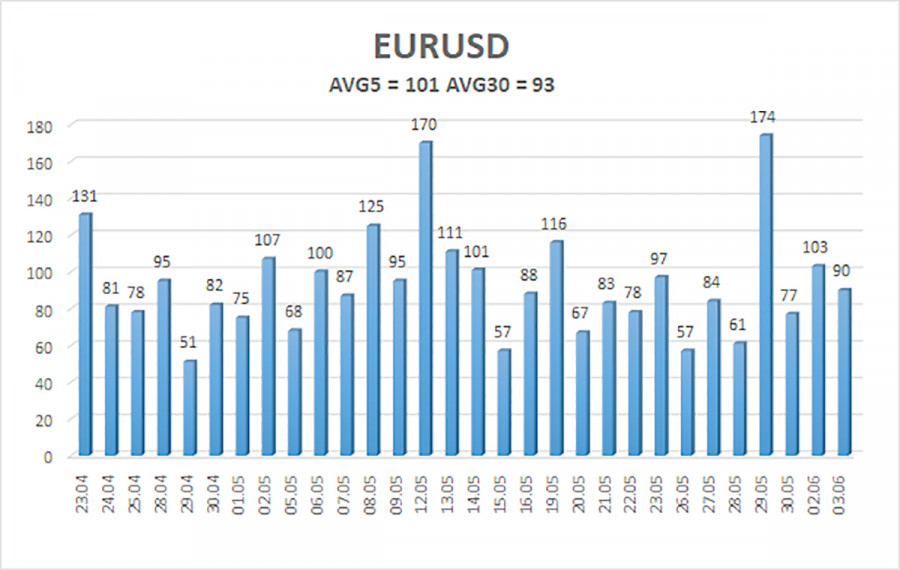

The average volatility of the EUR/USD pair over the last five trading days as of June 4 is 101 pips, which is considered "high." We expect the pair to move between the levels of 1.1275 and 1.1477 on Wednesday. The long-term regression channel is directed upward, still indicating an uptrend. The CCI indicator dipped into the oversold zone, and a bullish divergence formed, suggesting a trend resumption in the uptrend.

Nearest Support Levels:

S1 – 1.1353

S2 – 1.1292

S3 – 1.1230

Nearest Resistance Levels:

R1 – 1.1414

R2 – 1.1475

R3 – 1.1536

Trading Recommendations:

The EUR/USD pair is attempting to resume its uptrend. For months, we have been saying that only a fall in the euro is expected in the medium term because the dollar still has no reason to decline—other than Trump's policies, which are likely to have devastating long-term effects on the U.S. economy. However, the market shows a complete unwillingness to buy the dollar even when reasons to do so exist, completely ignoring positive factors for the dollar. When the price is below the moving average, short positions targeting 1.1292 and 1.1275 are relevant, but a significant fall should not be expected under current conditions. Long positions can be considered above the moving average line, with targets at 1.1475 and 1.1536.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.