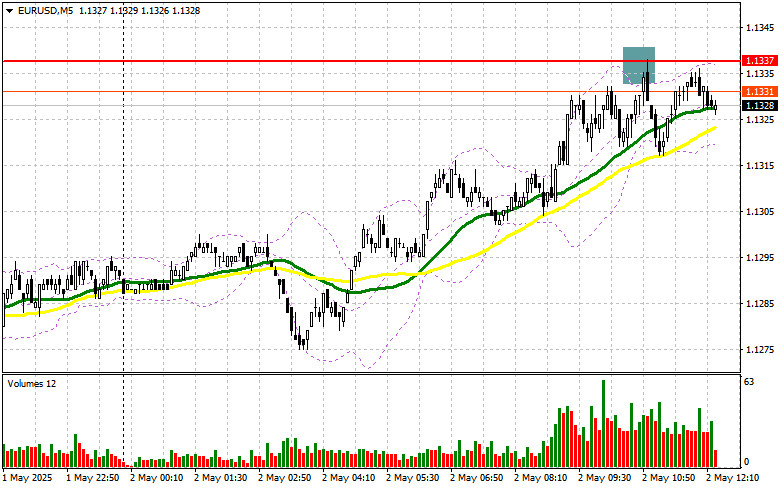

In my morning forecast, I highlighted the 1.1337 level and planned to make market entry decisions based on it. Let's look at the 5-minute chart and analyze what happened there. The rise and formation of a false breakout around 1.1337 provided a good entry point for selling the euro, resulting in only a 20-point drop in the pair before the pressure subsided. The technical picture was revised for the second half of the day.

To Open Long Positions on EUR/USD:

The second half of the day will be decisive for the dollar and possibly for the Federal Reserve's monetary policy. If the U.S. Nonfarm Payrolls report for April turns out worse than economists expect, it will almost certainly push the Fed to cut rates soon. However, it's difficult to predict how the dollar will react—especially given its recent strength despite weak GDP data earlier this week. It's better to rely on the market's reaction to the data before making decisions.

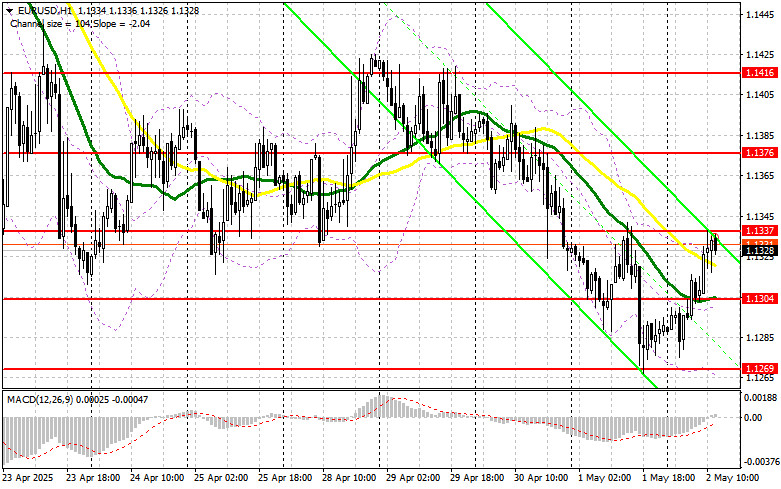

If the pair declines, I plan to act from the major support at 1.1304, formed during the first half of the day. A false breakout there will be a reason to buy EUR/USD, targeting a recovery toward 1.1337, which we failed to break through earlier today. A breakout and retest of this range from above would confirm a valid entry point, with a further move toward 1.1376. The ultimate target will be 1.1416, where I will take profit.

If EUR/USD drops and there is no activity around 1.1304, pressure on the pair could increase significantly, potentially leading to a further decline toward 1.1269. Only after a false breakout there will I consider buying the euro. I also plan to open long positions on a rebound from 1.1219 with an intraday target of 30–35 points upward.

To Open Short Positions on EUR/USD:

If the euro rises after the U.S. labor market data—which is also likely—bears will need to assert themselves around 1.1337. Only a false breakout there, similar to the one I discussed earlier, will justify entering short positions targeting the 1.1304 support level, where the moving averages—currently favoring bulls—are located. A breakout and consolidation below this range would be an ideal scenario for selling, with a move toward 1.1269. The final target will be 1.1219, where I will take profit. A test of this level would break the bullish market.

If EUR/USD climbs further in the second half of the day and there is no bearish activity around 1.1337, buyers could push the pair to 1.1376. I will only sell from that level after an unsuccessful consolidation. I also plan to sell on a rebound from 1.1416 with a 30–35 point downward correction target.

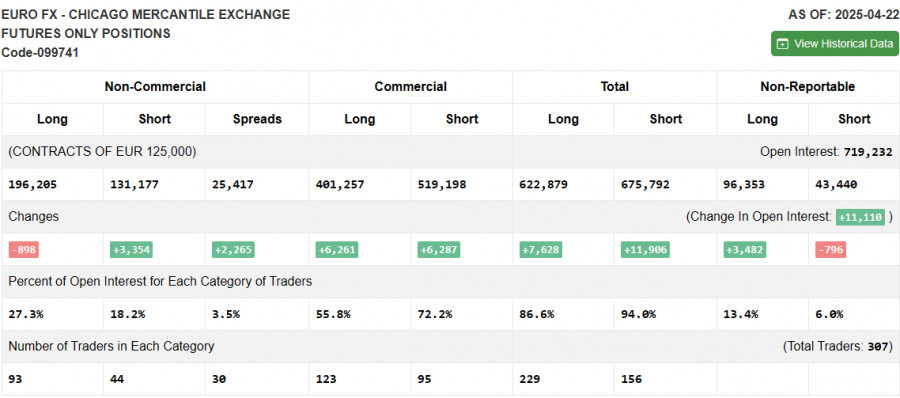

In the Commitment of Traders (COT) report for April 22, short positions increased while long positions declined. Given that the European Central Bank is almost explicitly stating that it will continue cutting rates, this is currently preventing the euro from extending its rally against the U.S. dollar. Easing measures by Donald Trump and a possible trade deal compromise with China are gradually bringing buyers back to the U.S. dollar market.

According to the report, long non-commercial positions fell by 898 to 196,205 and short non-commercial positions rose by 3,354 to 131,177. The gap between long and short positions narrowed by 2,493.

Indicator Signals:

Moving Averages: Trading is taking place near the 30- and 50-day moving averages, indicating market uncertainty.Note: The periods and prices of moving averages are considered by the author on the H1 chart and may differ from classical D1 definitions.

Bollinger Bands: In the case of a decline, the lower boundary of the indicator around 1.1269 will serve as support.

Indicator Descriptions:

- Moving Average – smooths out volatility and noise to identify the current trend. Period: 50 (yellow line), 30 (green line).

- MACD (Moving Average Convergence/Divergence) – Fast EMA: 12, Slow EMA: 26, SMA: 9.

- Bollinger Bands – Period: 20.

- Non-commercial traders – speculators such as individual traders, hedge funds, and large institutions using the futures market for speculation.

- Long non-commercial positions – the total long open positions by non-commercial traders.

- Short non-commercial positions – the total short open positions by non-commercial traders.

- Net non-commercial position – the difference between short and long positions of non-commercial traders.