Bitcoin and Ethereum experienced a relatively quiet trading day, maintaining positive prospects for further growth following a significant sell-off earlier this week.

Yesterday, attention turned to an interview with Howard Lutnick, a candidate for the position of U.S. Secretary of Commerce. In this interview, he shared his thoughts on the digital asset market. Lutnick believes that Bitcoin is on the verge of mass adoption in traditional finance; however, he argues that Bitcoin should not be classified as a currency, as doing so could challenge state authority. Instead, he suggests that if Bitcoin is recognized as a commodity, it would lead to widespread acceptance, with no issues concerning the implementation of new digital technologies.

Lutnick pointed out that categorizing Bitcoin as a commodity would help avoid the strict regulations typically associated with currencies. This approach would facilitate the broader integration of Bitcoin and other digital assets into existing financial systems. The significance of this decision lies in the fact that many investors, concerned about potential government crackdowns, may be less active in the market if Bitcoin is perceived solely as a digital currency. According to Lutnick, acknowledging Bitcoin (BTC) as a commodity would pave the way for increased adoption of smart contracts and decentralized finance (DeFi). This shift could enhance market liquidity and enable small and medium-sized businesses to conduct transactions using Bitcoin while minimizing the risks related to price volatility.

Lutnick also stressed that Bitcoin is a rare asset and asserted that now is the optimal time to invest. He disclosed that he has already invested millions of dollars and anticipates a significant rise in Bitcoin's value in the near future. In the event of a correction, Lutnick intends to expand his holdings, with the goal of building substantial capital.

Regarding the intraday strategy for the cryptocurrency market, I will continue to take action, especially during significant pullbacks of Bitcoin and Ethereum, as I anticipate the bull market will persist in the medium term.

The following section outlines my strategy and conditions for short-term trading.

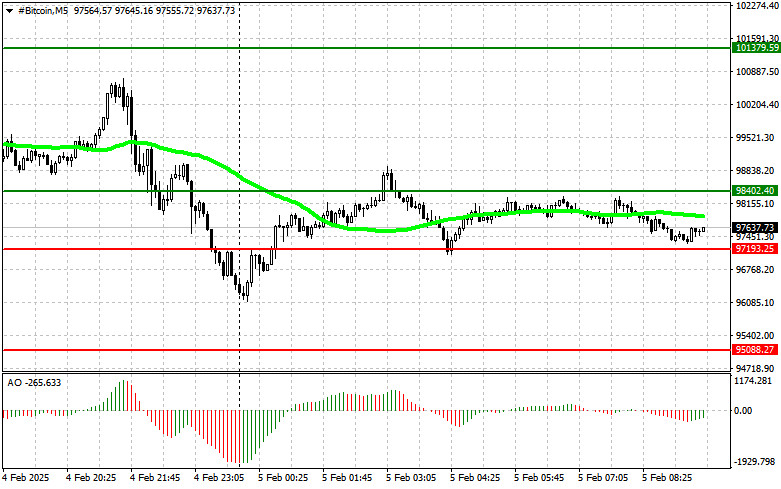

Bitcoin

Buy Scenario

Scenario #1: I will buy Bitcoin today if the price reaches the entry point around $98,400, targeting growth to $101,300. I will exit long positions around $101,300 and sell immediately on the rebound. Before buying on a breakout, ensure the 50-day moving average is below the current price and the Awesome Oscillator is above zero.

Scenario #2: I will also buy Bitcoin from the lower boundary at $97,200 if there is no market reaction to breaking this level, aiming for a rebound to $98,400 and $101,300.

Sell Scenario

Scenario #1: I will sell Bitcoin today if the price reaches the entry point around $97,200, targeting a drop to $95,000. I will exit short positions around $95,000 and immediately buy on the rebound. Before selling on a breakout, ensure the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

Scenario #2: If the market does not react to breaking this level, I will also sell Bitcoin from the upper boundary at $98,400, targeting a decline to $97,200 and $95,000.

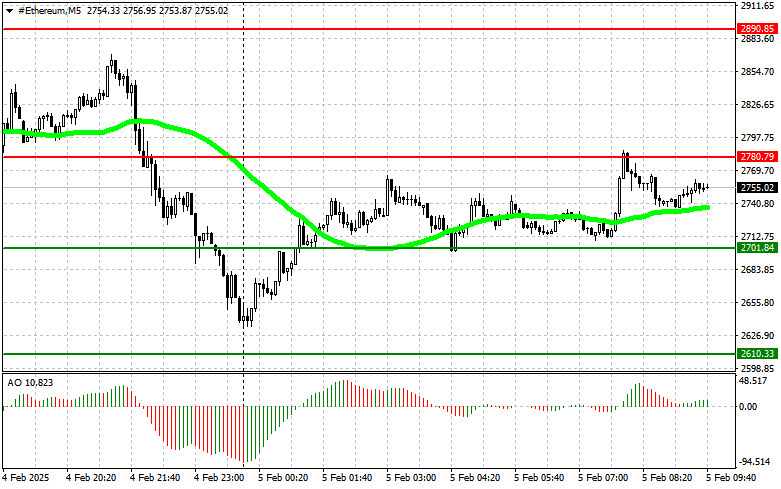

Ethereum

Buy Scenario

Scenario #1: I will buy Ethereum today if the price reaches the entry point around $2,780, targeting growth to $2,890. I will exit long positions around $2,890 and sell immediately on the rebound. Before buying on a breakout, ensure the 50-day moving average is below the current price and the Awesome Oscillator is above zero.

Scenario #2: If the market does not react to breaking this level, I will also buy Ethereum from the lower boundary at $2,700, aiming for a rebound to $2,780 and $2,890.

Sell Scenario

Scenario #1: I will sell Ethereum today if the price reaches the entry point around $2,701, targeting a drop to $2,610. I will exit short positions around $2,610 and immediately buy on the rebound. Before selling on a breakout, ensure the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

Scenario #2: I will also sell Ethereum from the upper boundary at $2,780 if there is no market reaction to breaking this level, targeting a decline to $2,700 and $2,610.